Connecting local capital to global real estate

The PERE Network Japan Korea Week connects you with the biggest institutional investors in Japan and Korea.

Join us in Tokyo and Seoul to understand which real estate markets in Asia and abroad are attractive to investors and the criteria they are adopting to allocate their capital.

Become a PERE Network member and join us at the Japan Korea Week to expand your network and advance your fundraising, gaining access to the most influential network of active Japanese and Korean investors.

The largest gathering of Japanese and Korean institutional investors ever, including:

Whitepaper: A growing wave of capital: Japanese & South Korean institutional investor appetite for global real estate

Access our latest comprehensive report which dives into the profound impact that Japanese and South Korean investment has had on the global real estate landscape over the past decade. Gain insights into the growing wave of capital arising from the region so you can strengthen your strategic position.

Two Forums, Unlimited Networking Opportunities

Why PERE Japan Korea Week?

Boost your fundraising

Discover Japanese & Korean investor needs and align your investment strategies with their allocation appetite.

Gain strategic insight

Understand how to strategically position your portfolio to appeal to Japanese & Korean investors, learn from peers how to tailor to pitch to regional investors.

Better connections

Set up pre-event meetings and continue the conversation after the Japan Korea Week with your membership to PERE Network. Gain access to 1,400+ investors and managers globally, regular monthly insights and online meetings with fellow industry leaders.

Thought leadership, branding and networking opportunities

Be part of thought-provoking discussions with leading institutional investors, fund and asset managers, developers, advisers, and strategic partners. Sponsorship gives you:

- VIP access

- Thought-leadership opportunities

- High-profile branding

- And much more …

For exclusive sponsorship packages, contact Nick Hayes, our Global Business Development Director of Real Estate at nick.h@pei.group

2022 speaking faculty included

Interested in speaking at PERE Japan Korea Week 2023? Please contact Rida Shaikh today.

Steven Bass

Senior Director, Portfolio Manager, Alternatives and Strategic Transactions, Nuveen Real Estate

Daniel R. Dubrowski

Co-Founder and Head of Capital Formation, Lionstone Investments/Columbia Threadneedle Investments

Akihisa Hoshino

Associate General Manager, Alternative Funds Investment Department, Sumitomo Mitsui Trust Bank

Seung-hwan Hwang

Head of Global Real Estate Investment and Head of Alternative Portfolio Operations, Hanwha Asset Management

Satoshi Ikeda

Chief Sustainable Finance Officer and Deputy Commissioner for International Affairs, Financial Services Agency, Government of Japan

Seonghun Min

Professor, The Department of Urban Planning and Real Estate, The University of Suwon (Investment Committee Member, NPS, GEPS and HUF)

Katsuyuki Tokushima

Director, Member of the Board and Head of Pension Research and ESG Development, NLI Research Institute

Simon Treacy

Chief Executive Officer, Private Equity Real Estate, Real Assets, CapitaLand Investment

Thought leadership, branding and networking opportunities

Be part of thought-provoking discussions with leading institutional investors, investment, fund and asset managers, developers, advisers, and strategic partners.

Sponsorship offers you:

- Thought-leader speaking opportunities

- VIP access for you and your team

- High-profile branding before, during and after the Forum

- And much more …

For exclusive sponsorship packages for 2025, contact Charlotte Hung, our Global Business Development Manager of Real Estate at charlotte.h@pei.group

Japan Korea Week attendees get more

By attending PERE Japan Korea Week you will join real estate’s most influential global community, PERE Network. Membership will give you access to:

- PERE Connect – our new tailored networking service

- Content and insights to drive better decisions

- Access to the investor directory

- And much more …

Talk to our team to find out how the Forums and the PERE Network membership can help grow your firm.

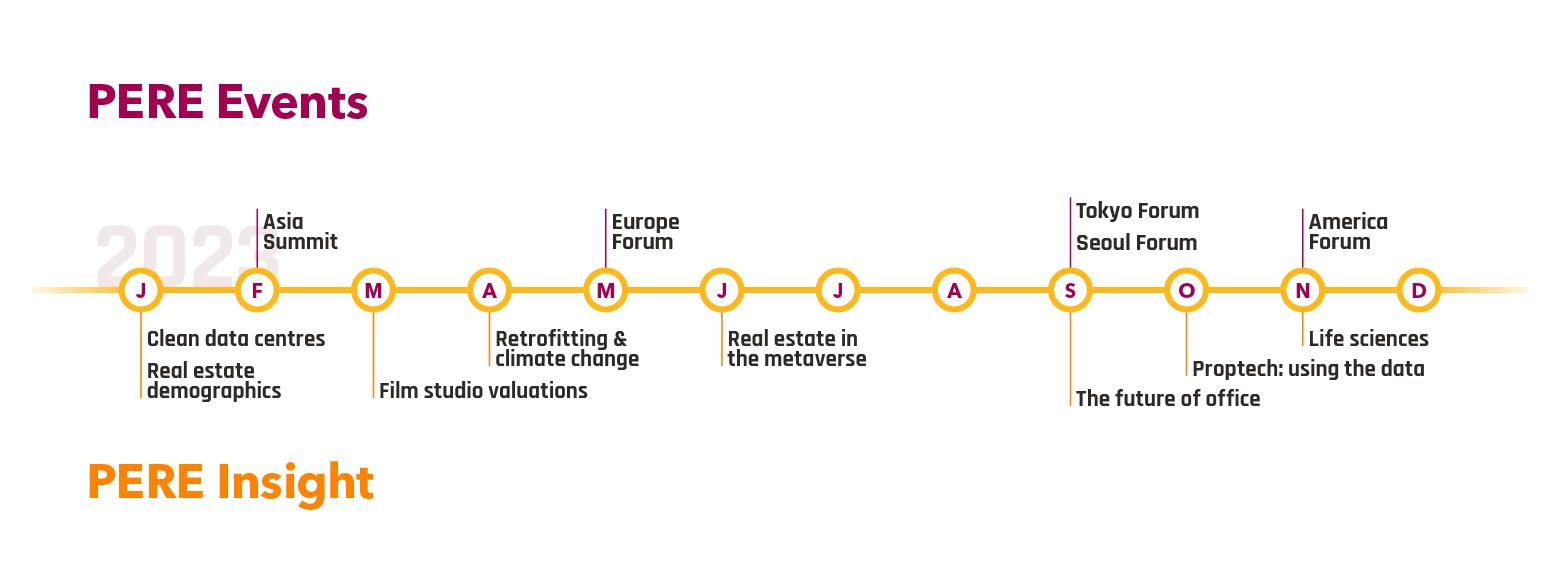

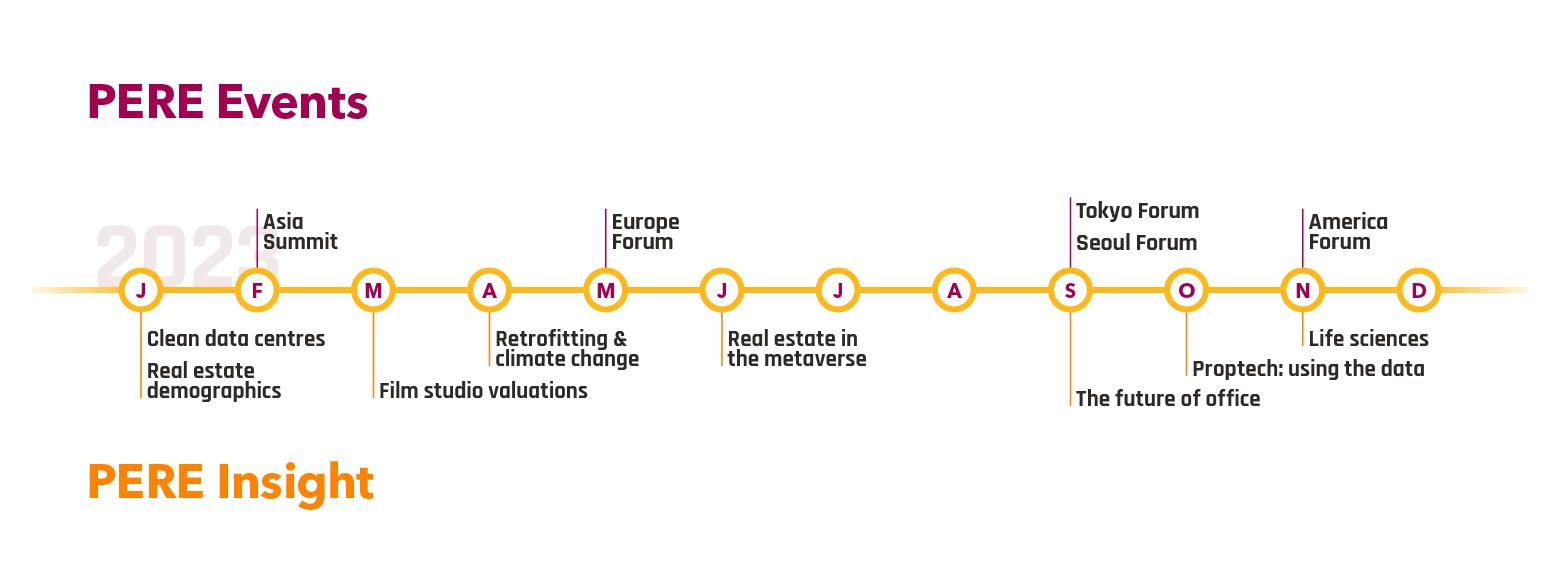

PERE Global Events

Join our events globally to gain access to in-depth content, insights, and in-person networking opportunities with institutional investors. Contact our team to learn more.

THE NETWORK FOR GLOBAL REAL ESTATE

Make better connections at the Japan Korea Week and beyond

The PERE Network is a year-round program of networking and content that enhances the experience of our members at the PERE Japan Korea Week.

Members can connect with more than 1,400 investors and managers throughout the year, setup pre-meetings with those attending the Forums, meet in-person on the day, or pick up a conversation after the Forums:

- Find investors who match your investment strategies and set up meetings ahead of the event on our membership platform.

- Get personalised introductions to investors that fit your profile from our dedicated networking team before, during, and after the event.

- Access unique, critical insights exclusive to members throughout the year along with preferential rates to attend any event within the global PERE portfolio

Our network makes decisions that shape markets

Explore opportunities with investors from across the globe today with access to the most influential private real estate network.

Pre-Event Resources

Institutional Investors at PERE Japan Korea Week 2023

Complimentary passes are available for allocators and institutional investors to join the PERE Network’s Japan Korea Week.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will follow up with you to secure your pass.

Previous institutional investors that have attended include

What to expect on the event day

Investors at PERE Japan Korea Week 2023

The forum is the largest meeting place for institutional and private investors, and other members of the real estate community in Japan and Korea.

Check out the benefits of joining the conference and who among your peers you will be joining. Apply for a complimentary pass for your or your team today.

Meet the biggest global funds

Network and arrange one-to-one meetings with the biggest and leading real estate managers before, during and after the event.

Network with your peers

Connect with your peers and understand their strategies and allocation approach to real estate.

Get the latest insights

Discuss the opportunities and challenges your peers are facing in the market.

Explore opportunities

Find investment opportunities across traditional and emerging sectors.

View the key conversation topics

Download the agenda to see the trends shaping Japanese and Korean investors allocation strategies and markets across the region.

Have a topic that you would like to discuss on the agenda? Contact Rida Shaikh today.

Agenda

PERE Seoul Forum - main day - Tuesday 19th

Registration and coffee

Investor breakfast briefing (invitation only)

A closed-door breakfast briefing for institutional investors. By invitation only.

PERE welcome and opening remarks

Keynote speech

Presentation – The PERE analysis of global private real estate fundraising trends

Keynote panel: The to-do list for the next five years

- What are the top trends to look out for in global real estate and how you can refine your investment strategy

- Prepare for the challenges ahead by understanding risks in private real estate; protect your portfolio from imminent threats of economic recession and bankruptcies in banking

- How you can make “smarter” investments; a deep dive into the strengthening relationship between tech and property

Panel: Looking towards the West

- What are the hottest real estate investment destinations outside of Asia? A deep dive into market performance and a sector-by-sector analysis of return on investment

- How Korean investors should be structuring their investments in the next deal they make with a global fund manager

- Working together in harmony; what are the differences in practices and culture, and how new funds in the market can adapt their pitch to suit Korean investors?

Networking coffee break

Keynote interview- How the Korean real estate market will be reformed

- Looking inward at the domestic real estate market

- What’s needed to turn Korea into an attractive investment hub for domestic and overseas investors?

- Which sectors are being developed and supported by government incentives?

Investor Panel: Understanding Korean insurance companies and their appetite for real estate

- How will the scale of commitments to real estate funds change in the coming years?

- What are the most pressing concerns for Korean insurers making allocation decisions?

- How can fund managers better cater to Korean insurers?

Case Study: Where are the women in Korean real estate?

- A deep dive into the demographics of Korean institutional investors, real estate funds and portfolio

- How do you rebuild a culture that encourages women’s participation in the industry?

- How do you effectively recruit and promote women to senior positions in real estate?

Networking lunch break

Investor Panel: What are Korean pension funds looking for in the year of 2024?

- To allocate or over-allocated? Are Korean pension funds looking to make new commitments?

- What are the unique needs of pension funds and how fund managers can accommodate them i.e. diversification, liquidity, etc.

- What’s the preferred method for Korean pension funds to access the asset class: co-investments or direct?

Panel: Seek no further than Asia-Pacific

- Locate the fastest growing cities and sectors within Asia

- Investigate the risk/ return profiles of different regions

- What’s the beginner’s way into a fast-growing Asia-focused portfolio?

Networking coffee break

Investor Panel: The pursuit of net-zero and its effect on valuations

- How do you manoeuvre your firm and its investments to net-zero emissions?

- To what extent did choosing a net-zero fund raise the asset’s value?

- What advice do you have for asset owners and managers who are just starting out on their net-zero journeys?

Interactive Think Tanks: What is new and exciting in 2024 and beyond

Be part of a curated, interactive group discussion; brainstorm for exciting trends and converse about little-known niches while cocktails are served.

Closing remarks (followed by Networking Cocktails)

Agenda

PERE Tokyo Forum - Thursday 21st

Registration and coffee

Investor breakfast briefing (invitation only)

A closed-door breakfast briefing for institutional investors. By invitation only.

PERE welcome and opening remarks

Keynote speech

Presentation – The PERE analysis of global private real estate fundraising trends

Keynote panel: Industry leaders predict trends for next 5 years

- What are the top trends to look out for in global real estate and how you can refine your investment strategy

- Prepare for the challenges ahead by understanding risks in private real estate; protect your portfolio from imminent threats of economic recession and bankruptcies in banking

- How you can make “smarter” investments; a deep dive into the strengthening relationship between tech and property

Panel: Looking towards the West

- What are the hottest real estate investment destinations outside of Asia? A deep dive into market performance and a sector-by-sector analysis of return on investment

- How Japanese investors should be structuring their investments in the next deal they make with a global fund manager

- Working together in harmony; what are the differences in practices and culture, and how new funds in the market can adapt their pitch to suit Japanese investors?

Networking coffee break

Keynote Interview- What reforms the Japanese real estate market needs

- Looking inward at the domestic real estate market

- What’s needed to turn Japan into a top-tier investment hub for domestic and overseas investors?

- Which sectors are being developed and supported by government incentives?

Investor Panel: Understanding Japanese investors and their appetite for real estate

- How will the scale of commitments to real estate funds change in the coming years?

- What are the most pressing concerns for Japanese investors making allocation decisions?

- How can fund managers better cater to local asset owners?

Case Study: Where are the women in Japanese real estate?

- A deep dive into the demographics of Japanese institutional investors, real estate funds and portfolio

- How do you rebuild a culture that encourages women’s participation in the industry?

- How do you effectively recruit and promote women to senior positions in real estate?

Networking lunch break

Investor Panel: What are Japanese pension funds looking for in the year of 2024?

- To allocate or over-allocated? Are Japanese pension funds looking to make new commitments?

- What are the unique needs of pension funds and how fund managers can accommodate them i.e. diversification, liquidity, etc.

- What’s the preferred method for Japanese pension funds to access the asset class: co-investments or direct?

Panel: Seek no further than Asia-Pacific

- Locate the fastest growing cities and sectors within Asia

- Investigate the risk/ return profiles of different regions

- What’s the beginner’s way into a fast-growing Asia-focused portfolio?

Networking coffee break

Investor Panel: The Net-Zero Asset Owner Alliance of Japanese insurers

- Hear from Japanese members of the UN-convened alliance on to decarbonise your portfolio

- What is the relationship between a fund’s carbon emissions and its performance or valuation?

- What advice can you give to other asset owners and managers who are just starting out on their net-zero journeys?

Interactive Think Tanks: What is new and exciting in 2024 and beyond

Be part of a curated, interactive group discussion; brainstorm for exciting trends and converse about little-known niches while enjoying cocktails from our open bar.

Closing remarks (followed by Networking Cocktails)

ローカル資本とグローバルな不動産をつなぐ

「PERE Japan Korea Week」は、日本と韓国の大手機関投資家と皆様をつなぐイベントです。

東京とソウルの対面イベントに参加し、海外投資家がどのようなプライベート不動産の機会を求めているのか、そして彼らが資本配分のために採用している基準を理解しましょう。

最も影響力のある日韓投資家が大きいネットワークに入り、ネットワークを広げ、資金調達を進めることができます。

つのフォーラム、無限の資金調達の機会

日本と韓国の不動産ネットワークを拡大

グローバルな投資家ネットワークに参加して、関係を強化し、知名度を上げましょう。

「PERE Japan Korea Week」で、さらに良いつながりを実現

参加者は全員、「PERE Japan Korea Week」のネットワーキング体験をさらに充実させるために作成されたプラットフォーム、「PERE Network」の12ヶ月会員権を取得します。

会員は、年間を通じて1,000人以上の投資家や運用会社と交流し、フォーラム参加者との事前ミーティングを設定したり、当日に直接会ったり、 フォーラム後に会話を再開したりすることができます。

機関投資家向け無料参加パスを申し込む

限定数となりますが、本イベントでは、アロケーターや機関投資家を対象とした無料な参加パスのご用意があります。

投資家向け参加パスは、財団、基金、保険会社、シングルファミリーオフィス、政府系ファンド、積極的に出資を行う年金基金に限定され、第三者による資金調達活動を行わず、助言やコンサルティングサービスに対する手数料を徴収していないことが条件となります。

お申し込みいただいた方には、弊社担当者よりパスの確保についてご連絡差し上げます。

한국 자본을 글로벌 부동산 시장과 연결

PERE Japan Korea Week 는 당신을 한국과 일본의 가장 큰 기관 투자자들과 연결합니다.

서울과 도쿄에서 저희와 함께 해외 투자자가 찾고있는 사모부동산 기회와 자본배분 기준을 이해하세요.

네트워크를 확장하고 가장 영향력 있는 한국 및 일본 투자자 네트워크를 통하여 자금 조달을 진행하세요.

두 개의 포럼, 무한한 펀드레이징 기회

한국과 일본의 사모 부동산 업계 네트워크 확장하기

글로벌 투자자 네트워크를 통해 긴밀한 관계를 구축하고 시장에 대한 가시성을 높이세요.

PERE Japan Korea Week 에서 최고의 인맥 만들기

모든 PERE Japan Korea Week 참석자는 네트워킹 플랫폼인 PERE Network의 12개월 멤버십에 가입이 됩니다.

저희 멤버십 회원은 플랫폼을 통해 연중 1,000명 이상의 투자자 및 펀드매니저들과의 이벤트 전후 네트워킹을 하실 수 있습니다.

무료 기관 투자자 패스 신청

적합한 기관 투자자에게는 무료 포럼 참석권이 제공됩니다.

무료 투자자 패스는 재단, 기부금, 보험 회사, 단일 패밀리 오피스, 국부 펀드 및 연금 기금등 펀드 LP 출자를 적극적으로 하고 자문/컨설팅 서비스에 대한 수수료를 징수하지 않는 기관으로 제한됩니다

패스를 신청하시면 저희 팀이 참석 가능 여부를 알려드립니다.

Our leading advisory board in 2023

Interested in speaking at PERE Japan Korea Week 2023? Please contact Rida Shaikh today.

Akihisa Hoshino

Associate General Manager, Alternative Funds Investment Department, Sumitomo Mitsui Trust Bank

Atsuko Iino

Head of Alternative Investment, Asset Management Department, National Pension Fund Association