Driving the future of European sustainable finance

Join leaders in sustainable finance at Responsible Investor’s 18th annual RI Europe conference. Connect, collaborate, and explore the latest ESG innovations and best practices to stay ahead in a rapidly changing financial landscape.

Don’t miss your chance to be part of the transformation – connect with over 600 investors and fund managers, engage in interactive discussions, and gain first-hand insights from the visionaries advancing sustainable finance across Europe.

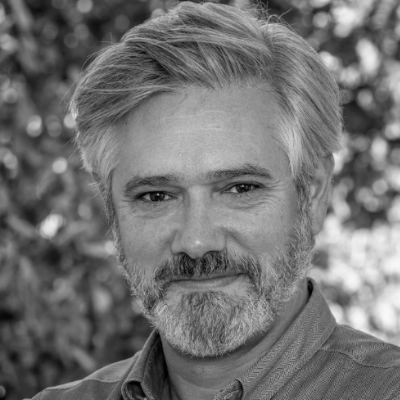

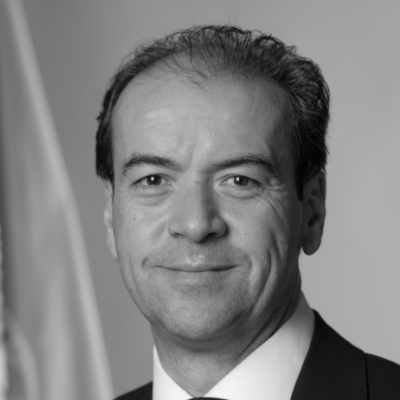

World-class speakers at RI Europe 2025 include:

Snapshot of this year's attendees

Meet over 150 leading asset owners, including:

Key themes for 2025:

Transition finance

Discover the challenges and opportunities for 2025 and beyond

Facing up to a warmer world

Navigating physical climate risk and adaptation

Navigating Regulation

Across the globe, from the EU and UK, to the US and beyond

Nature investment and data

Taking the next steps to scale up, assess risk and evaluate impact

The future of stewardship

Focusing in on leverage and accountability

Unlocking innovation

Identify the next generation of sustainable funds

What can you expect at the forum?

Get real insight into the industry

RI Europe’s innovative programme gets straight to the point on what sustainability means for business and investment in the real world. Topics include EU regulatory landscape, road to net zero, transition finance and many more.

Stay ahead of market trends

Be in the know about upcoming changes to regulations, latest trends and emerging opportunities in the world of responsible investment. Keep your strategies fresh and adapt to the rapidly evolving landscape.

Connect with the ESG community

Meet with the ESG community at the forefront of shaping sustainable finance in Europe. Engage with investment professionals, regulators, academics, NGOs, and legal experts who are driving meaningful change in the industry.

Are you an asset owner in public markets?

A limited number of complimentary passes are available for eligible asset owners to join the event.

To qualify for a complimentary pass, you must meet the eligibility criteria in representing a pension fund, insurance company, sovereign wealth fund, foundation, endowment, trust, family office or corporate investment division.

Apply for a pass and a member of our team will follow up with you to secure your pass.

Apply for a complimentary pass

Connect with investors & ESG professionals

Responsible Investor Europe provides an opportunity to make connections with an exclusive audience of ESG and sustainable finance decision makers. Share your solutions, collaborate and network with senior-level executives through bespoke sponsorship packages to meet your 2025 business goals.

For more information on the agenda or speaking opportunities, please contact Finlay Eglinton.

finlay.eglinton@pei.group| +44 20 3640 7518

Agenda

RI Europe 2025 - Day 1 - Wednesday 11th

Registration and refreshments

Opening remarks

Plenary 1: Investment and sustainability: Squaring the circle?

- How does sustainability fit into investment strategies in 2025?

- Performance first: Balancing net zero and fiduciary duty

- The universal owner: Taking a multi-asset approach

- Resource allocation: Setting priorities, doing more with less

Moderator: Lucy Fitzgeorge-Parker, Editor, Responsible Investor

Rasmus Bessing, Managing Director, Head of ESG Investing & Co-CIO, PFA

Pedro Antonio Guazo Alonso, CEO, UN Joint Staff Pension Fund

Morten Nilsson, CEO, Brightwell

Claudia Kruse, Managing Director RI Strategy, APG

Plenary 2: Climate investing 2.0: New opportunities, new challenges

- How is asset owner and asset manager thinking on climate evolving?

- Where are the next generation of climate opportunities?

- Climate adaptation and physical changes: Risk or opportunity?

- Transition finance: New market or marketing label?

Moderator: Elza Holmstedt Pell, Deputy Editor, Responsible Investor

Viola Tang, Vice President – Sustainability Office, GIC

Richard Mattison, Head of ESG & Climate, MSCI

Bertrand Millot, Head of Sustainability, CDPQ

Faith Ward, Chief Responsible Investment Officer, Brunel Pension Partnership

Networking break

Keynote

Plenary 3: Implementing EU sustainability regulation: The insiders’ view

- The Draghi effect: Sustainability and the EU’s competition drive

- CSRD year one: Early wins and teething troubles

- The omnibus effect: Is regulation consolidation a realistic solution?

- SFDR review: Lessons from the first four years

Moderator: Fiona McNally, Senior Reporter, Responsible Investor

Elise Attal, Head of EU Policy, PRI

Theresa Nabel, Co-Head, Sustainable Finance Center, BaFin

Sven Gentner, Head of Unit, DG Fisma

Plenary 4: Nature in public markets: Risk, return and innovation

- To what extent are investors equipped to understand nature-related risk to portfolios?

- How far is TNFD reporting addressing the nature data gap?

- What makes for effective engagement with corporates on nature-related issues?

- Are public markets suitable for nature-positive investment strategies?

Moderator: Gina Gambetta, Senior Reporter, Responsible Investor

Kate Turner, Global Head of Responsible Investment, First Sentier

Thomas Viegas, Group Nature Lead – Group Sustainability, Aviva

Anita De Horde, Co-Founder & Executive Director, Finance for Biodiversity

Ingrid Kukuljan, Head of Impact & Sustainable Investing, Federated Hermes

Joe Horrocks-Taylor, Senior Associate, Analyst, Responsible Investment, Columbia Threadneedle

Joe Horrocks-Taylor

Vice President, Sustainable Research, Columbia Threadneedle Investments

Read bioLunch

A1: Hard questions on hard-to-abate: What should investors do?

- How should investors engage with firms in hard-to-abate sectors on decarbonisation?

- Interventions and incentives: What could have a “catalytic” effect for challenged industries?

- Which traditionally hard-to-abate sectors are closest to decarbonisation solutions?

- Offset or avoid: how should investors navigate companies/sectors that may never be able to decarbonise?

Moderator: Carmen Nuzzo, Professor in Practice – Executive Director, TPI Centre, London School of Economics

Laith Cahill, Head of Stewardship Research, IIGCC

Laura Hillis, Director, Climate & Environment, Church of England

Short turnaround break

A2: Financing the energy transition in Asia

- Which countries and sectors offer the most interesting opportunities for global investors?

- What are the main hurdles to funding the transition in Asia for institutional investors?

- What can Asian governments and corporates do to facilitate global institutional investment in the energy transition?

- How can investors support the development of investible opportunities?

Moderator: Khalid Azizuddin, Senior Reporter, Responsible Investor

B1: AI and stewardship: New frontiers?

- E, S or G: which should be the priority for investors engaging corporates on AI?

- Can AI development and use be reconciled with net zero goals?

- Where in the AI value chain can investors engage most effectively?

- What lessons can be learned from the first generation of shareholder proposals on AI?

Moderator: Gina Gambetta, Senior Reporter, Responsible Investor

Vincent Kaufmann, CEO, Ethos

Short turnaround break

B2: Manager selection: Future-proofing mandates

- How are asset owners’ sustainability requirements of managers evolving?

- Are investors moving beyond a tick-box approach to mandates?

- What do managers need from mandates on ESG and sustainability?

- How important is stewardship in winning mandates?

Moderator: Melanie Jarman, ESG Delivery Lead, The Pensions Regulator (TPR)

Emma Adair, Partner, LCP

Claire Curtin, Head of ESG and Sustainability, Pension Protection Fund

Paul Lee, Head of Stewardship & Sustainable Investment Strategy, Redington

Stephanie Christiansen, Senior Sustainable Investment Specialist, Velliv

C1: Social data: Are investors getting what they need?

- Materiality analysis: which datasets are most relevant for investors?

- Where are the gaps in social data and can they be filled?

- How usable are estimated datasets?

- How will sustainability reporting and due diligence regulations change the social data landscape?

Moderator: Fiona McNally, Senior Reporter, Responsible Investor

Simon Rawson, Executive Director, Taskforce on Inequality and Social-related Financial Disclosures (TISFD)

Dan Neale, Responsible Investment Social Themes Lead, Church Commissioners for England

James Lockhart Smith, VP, Head of Sustainable Finance, Verisk Maplecroft

Simon Rawson

Executive Director, Taskforce on Inequality and Social-related Financial Disclosures (TISFD)

Read bio

Short turnaround break

C2: Nature data: Assessing risk and impact

- How are investor requirements on nature data evolving?

- Do investors have what they need to assess portfolio nature risk?

- Where can data be most useful in helping investors assess nature impact?

- TNFD, ESRS, ISSB: can disclosure standards produce comparable, decision-useful nature data?

Moderator: Gemma James, Head of Biodiversity and Nature, Chronos Sustainability

Stephanie Hime, Founder/Co-Founder, Little Blue Research

Mario Abela, Director of Standards, GRI

Networking break

Interactive Session: Let’s Get Physical!

An immersive hybrid session dedicated to understanding and modelling physical climate risk, combining expert guidance with innovative team exercises

Chair: Jakob Thomä, Co-Founder and CEO, Theia Finance Labs. Author of Pocket Guide to Planetary Peril

Richard Mattison, Head of ESG & Climate, MSCI

Networking drinks

End of day one

Agenda

RI Europe 2025 - Day 2 - Thursday 12th

Registration and refreshments

Invitation only AO breakfast

Join fellow asset owners for a breakfast briefing and peer-to-peer discussions. This is a closed-door session for asset owners only.

David Russell, Chair, Transition Pathway Initiative

A3: Deep Dive: Climate risk and resilience: Investing in a warmer world

- How are investors thinking about physical climate risk at portfolio level?

- Do investors have the data and tools they need to assess physical climate risk across portfolios?

- Where are the investment opportunities in climate adaptation?

- What are the barriers to investing in climate adaptation?

Craig Davies, CEO, Cadlas

Simon Atherton, Senior Climate Investment Risk Manager, Phoenix Group

Elizabeth Clark, Head of Investment Leaders Group, University of Cambridge Institute for Sustainability Leadership

Anthony Tursich, SVP, Co-Portfolio Manager, Calamos

Elizabeth Clark

Head of Investment Leaders Group, University of Cambridge Institute for Sustainability Leadership

Read bio

A4: Rethinking net zero: Targets, commitments and ambitions

- Are 1.5C and/or 2050 still realistic targets for investors?

- How have changes to GFANZ and its alliances affected financial institutions’ net zero ambitions and methodologies?

- Will meeting the first round of interim targets require divestment and/or excessive use of offsets?

- Is net zero delivering the outcomes needed for emerging markets?

Moderator: Lucy Fitzgeorge-Parker, Editor, Responsible Investor

Katharina Lindmeier, Head of Sustainability Strategy, Nest Pensions

David Russell, Chair, Transition Pathway Initiative

Eva Cairns, Head of Responsible Investment, Scottish Widows

A5: AI and ESG reporting: Lightening the load

- Can AI help ease the ESG reporting burden for investors?

- Where can investors most effectively deploy AI in the reporting process?

- What are the limits of AI use for ESG reporting?

- Will regulators put guardrails around reporting and AI?

Moderator: Elza Holmstedt Pell, Deputy Editor, Responsible Investor

Mark Hill, Climate and Sustainability Lead, The Pensions Regulator

B3: Deep Dive: Engagement tracking: Navigating an emerging space

- How are investors improving reporting and communication on engagement?

- What do asset owners want from managers and how is this changing?

- Correlation vs causation: what outcomes can investors credibly claim credit for?

- Where are the biggest challenges in engagement tracking?

Moderator: Will Martindale, Co-Founder, Canbury

Marie Marchais, Responsable Engagement, French SIF

Andres van der Linden, Senior Advisor Responsible Investment, PGGM

Paul Hewitt, Responsible Investment Manager, London Pensions Fund Authority (LPFA)

B4: Water: A rising risk

- Why has water become a key focus for investors?

- Water quality vs water quantity: which should investors be focusing on?

- Do investors have the tools they need to assess water risk?

- What does effective engagement on water-related issues look like?

Moderator: Rory Sullivan, CEO, Chronos Sustainability

Cate Lamb, Senior Freshwater Specialist- Nature Team, UNEP Economy

Micha van den Boogerd, Director Responsible Investments Services, TAUW

B5: Transition funds: Understanding new strategies

- Will the momentum behind transition funds continue?

- What do asset owners want from transition funds?

- How are transition strategies performing vs other climate strategies?

- To label or not to label?

Moderator: Khalid Azizuddin, Senior Reporter, Responsible Investor

Andy Ford, Head of Responsible Investments, St James Place

Sally Ronald, Head of Research, Border to Coast

C3: Deep Dive: Understanding supply chain risk: An investors’ guide

- How are investors engaging with corporates on supply chain risk?

- Where are the biggest gaps in corporate supply chain data?

- How is regulation affecting corporate supply chain reporting?

- Which supply chain issues are most material for investors?

Moderator: Gina Gambetta, Senior Reporter, Responsible Investor

Phil Davis, Director of ESG & Impact, Helios Investment Partners

Benjamin Michel, Sustainable Finance Lead & Due Diligence Policy Analyst, OECD Centre for Responsible Business Conduct

C4: The passive impact: The manager perspective

- How is asset owner thinking about passive funds developing and what does this mean for managers?

- Engaging with index providers: what are the important asks for investors?

- Should investors focus on engaging with constituents of passive index funds or re-weighting the funds?

- Has there been growing interest in engagement-only mandates for passive portfolios?

Moderator: Sandra Metoyer, Independent ESG Consultant

Leanne Clements, Head of Responsible Investment, Pension Partnership

Samantha Chew, Stewardship Lead, Investment Proposition, Aegon UK

C5: Green bonds: Impact and assessment

- How can investors ensure that green bonds deliver on their commitments?

- How are investors measuring the impact of green bond investments?

- Can SPO providers help improve green bond outcomes?

- Will the EU Green Bond Standard help raise standards in the market?

Moderator: Dominic Webb, Senior Reporter, Responsible Investor

Simone Utermarck, Senior Director, Sustainable Finance, ICMA

Marlene Eklund Kjær, Analyst, ESG, ATP

Networking break

Keynote

Plenary 5: Unlocking innovation: The next generation of sustainable funds

- Finding the sweet spot: What products are asset owners asking for?

- Understanding and navigating fund flows

- Making the case for sustainable funds in challenging times

- Is regulation a barrier to innovation in fund creation?

Moderator: Elza Holmstedt Pell, Deputy Editor, Responsible Investor

Piet Klop, Head of Responsible Investment, PGGM

Hetal Patel, Head of Sustainable Investment Research, Phoenix Group

Plenary 6: Corporate sustainability reporting and investor expectations

- Is the push for standardised corporate sustainability reporting living up to investor expectations?

- What changes do investors want when the CSRD is streamlined? Has the regulation helped investors and corporates so far?

- Corporate strategies: Navigating the push to cut red tape and the ESG backlash

Moderator: Kris Nathanail, Director, Standards Development, IOSCO

Richard Barker, Board Member, ISSB

Uwe Bergmann, Global Director ESG Business Integration, Henkel

Elizabeth Lance, Assistant Chief Counsel, Investment Company Institute

Lunch

Fireside Chat

Lucy Fitzgeorge-Parker, Editor, Responsible Investor

Carine Smith Ihenacho, Chief Governance and Compliance Officer, Norges Bank Investment Management

Plenary 7: Back to basics: Rethinking stewardship and engagement

- How to engage effectively with corporates for positive investment outcomes: A corporate and investor perspective

- Walking the line: How can asset managers meet the stewardship requirements of multiple clients?

- Skewed incentives: Can a focus on impact measurement cause unintended outcomes?

- Is policy engagement the only effective lever to address systemic risks?

Moderator: Gina Gambetta, Senior Reporter, Responsible Investor

Colin Baines, Stewardship Manager, Border to Coast

Kiran Aziz, Head of Responsible Investments, KLP Insurance Pension Fund

Ian Burger, Head of Stewardship and Integration, Universities Superannuation Scheme

The Big Debate: Defence and Sustainability

Motion: “This house believes that defence can be a sustainable investment”

An Oxford-style debate with audience participation through voting and contributions from the floor

Moderator: Dominic Webb, Senior Reporter, Responsible Investor

Closing remarks and end of conference

Network at Europe's leading responsible investment event

Join us in London for Responsible Investor’s 18th annual RI Europe conference in June 2025, the premier event for leaders in sustainable finance. Connect with over 600 top investors, fund managers, and industry professionals dedicated to shaping the future of responsible investment.

At RI Europe, networking goes beyond exchanging business cards—it’s about discovering shared values, aligning on goals, and building meaningful partnerships. Here, you’ll find the foundation for collaborations that drive impactful projects and long-term initiatives in sustainable finance.

From insightful sessions to interactive discussions, RI Europe is where today’s challenges meet tomorrow’s solutions. Don’t miss this opportunity to be part of the movement advancing sustainable finance across Europe.

The in-person networking experience

Meet industry thought leaders

Connect with the ESG community at the forefront of shaping sustainable finance in Europe. Engage with investment professionals, regulators, academics, NGOs, and lawyers who are driving meaningful change in the industry.

15+ hours of networking

Connect in-person with the ESG community at our interactive workshops, panels, private breakfasts, debates, and evening drinks reception. Every moment at RI Europe is a chance to forge valuable connections.

Build valuable connections with European asset owners

Engage with leading asset owners and gain insights into their ESG allocation strategies and preferences for their next investment partner. Past attendees include Aegon, Church of England Pensions Board, Folksam, Legal & General, Scottish Widows, Unilever APF, and many more.

Connect with active investors

Be recognised as driving the future of sustainable finance

Responsible Investor Europe provides an opportunity to make connections with an exclusive audience of ESG and sustainable finance decision makers. Share your solutions, collaborate and network with senior-level executives through bespoke sponsorship packages to meet your 2025 business goals.

Pre-Event Resources

If you would like to join the industry-leading line-up in June 2025, please contact Finlay Eglington.

finlay.eglinton@pei.group | +44 20 3640 7518

2025 speakers:

Elizabeth Clark

Head of Investment Leaders Group, University of Cambridge Institute for Sustainability Leadership

Carmen Nuzzo

Professor in Practice - Executive Director, Transition Pathway Initiative Centre (TPI Centre), London School of Economics

Simon Rawson

Executive Director, Taskforce on Inequality and Social-related Financial Disclosures (TISFD)

Be recognised as driving the future of sustainable finance to institutional investors in Europe

Sponsoring at Responsible Investor global events positions your company at the forefront of key decision-makers and ensures your profile gains a competitive advantage within the industry. Enquire about bespoke sponsorship packages to:

- Align your brand with Responsible investor’s authoritative content-led event portfolio and be seen as a go-to solution provider for senior ESG and sustainable finance professionals.

- Stand tall amongst your competitors by positioning your company at Responsible Investor Europe and embed your brand as a major player to senior institutional investors.

- Raise your profile as a thought leader within the industry to overcome the key challenges within responsible Investing.

- Showcase your institutional investor solutions, in-person to new global audiences and generate new business opportunities to achieve your targets.

2025 sponsor:

Connect with responsible investment investors

Hiroshi Komori

Senior Director, Stewardship & ESG, GPIF

RI events around the world have been beneficial to catch up on ongoing ESG issues and network with great people.

Andrea Palmer

ESG Lead, PGGM

I appreciate the quality of the delegates and the conversations. It’s the go-to venue to gauge developments in ESG integration.

Asset owners at RI Europe

Responsible Investor Europe provides an unrivalled platform for asset owners investing in ESG and sustainable finance. Join over 100 asset owners from across Europe to discuss the latest responsible investing trends and compare best practices and allocation strategies for 2025 and beyond.

A limited number of complimentary passes are available exclusively for asset owners. Explore the conference benefits and find out which of your peers will be attending. Apply now for a complimentary pass for yourself or your team.

What to expect

Network with your peers

Enrich your network, build lasting relationships, and exchange valuable perspectives with your fellow asset owners during asset owner-only breakfasts, networking breaks, lunches and much more.

Gain expert insights

Hear from our industry-leading speaker line-up, discover the latest trends and stay aligned with future innovations in the market.

Stay aligned to developments and opportunities

Discover remarkable investment opportunities and leverage ESG expertise focused on regulation, human rights, biodiversity, net zero and more.

Meet with the best and brightest funds

Connect and arrange one-to-one meetings with the biggest and best ESG managers in the market and find your next investment partner.

Asset owners at RI Europe.

‘This event stands as the largest gathering designed specifically for asset owners and top-level corporates, providing two days of networking and insightful discussions.

Explore the conference benefits and find out which of your peers will be attending.

Meet over 150 leading asset owners, including:

Apply for a complimentary asset owner pass

A limited number of complimentary passes are available for eligible asset owners to join the event.

To qualify for a complimentary pass, you must meet the eligibility criteria in representing a pension fund, insurance company, sovereign wealth fund, foundation, endowment, trust, family office or corporate investment division.

Apply for a pass and a member of our team will follow up with you to secure your pass.