Private Markets

Responsible Investment Forum: Europe

18 - 19 November 2025,

155 Bishopsgate, London

The leading global event for ESG in private markets

The 16th annual Responsible Investment Forum: Europe is retuning to London on 18-19 November 2025!

As the flagship event of the Responsible Investment Forum series, this event unites the leading institutional investors, fund managers, expert advisors, and influential sustainability leaders to explore the evolving landscape of responsible investment and its role in driving financial performance.

With a speaker line-up featuring top voices from across Europe and beyond, the forum serves as an essential platform for unveiling new initiatives and shaping the future of sustainable investment strategies.

Advance your business

Over two content-packed days, hear from an esteemed line-up of 100+ responsible investment and ESG professionals as they share their insights on key industry trends. Learn how they’ve tackled challenges and gain best practices to advance your business.

Build a valuable network

Connect with your peers throughout the forum during a range of networking opportunities, including: interactive workshops, roundtable discussions, an evening drinks reception and invite-only breakfasts for deeper connections.

Meet institutional investors

Advance your fundraising by building new relationships with leading investors who are looking to increase their exposure. Previous attendees include: AlpInvest, AP6, AustralianSuper, Guys and St Thomas Foundation, Hamilton Lane, Railpen and many more.

2024 Key Themes Included

- The evolution of sustainability within European private equity

- ICI initiative update: Decarbonisation pathways at both fund and portfolio company levels

- ESG integration in value creation plans

- Investor perspectives on sustainability in investment decisions

- SFDR update: How the regulation works in practice

- Sustainability and climate integration in private credit

- And more

Interested in sponsoring Responsible Investment Forum?

Shake hands with prominent global institutional investors, fund managers, consultants, and highly recognised associations to build effective ESG strategies focused on value creation and ROI.

3 global opportunities to:

• Raise your visibility as a figurehead in a crowded ESG market and align your brand with PEI’s global and diverse event portfolio.

• Differentiate your brand and stand out from your competitors by collaborating as a thought leader across leading global ESG events in private equity, infrastructure, and private debt.

• Raise your reputation as an expert in ESG amongst existing and future clients.

• Get ahead of ESG and impact fund regulations and be the go to provider in industry developments setting you apart from your competitors.

Get in touch with us today and let us put your company at the forefront of the industry.

Meet our 2024 speakers

What our attendees love about the forum

Alan Kao

Ramboll

Fantastic to see the progress on climate, diversity, human rights being made by so many investors!

Bill McGilivray

Ogier

The best conference I’ve attended in a very long time. Great content and speakers and very enthusiastic attendees make the 2 days well worthwhile.

Marina Johnson

Actis

Fantastic opportunity to meet with peers, to connect and challenge each other. Very well organised and run.

Apply for a complimentary investor pass

A limited number of complimentary passes are available for eligible allocators and institutional investors to join the event.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will be in touch to confirm your eligibility.

2024 Agenda

Our unique agenda features interactive working groups, panels, and exclusive discussions. It covers key topics such as ESG value creation, impact investing, and decarbonisation strategies, offering actionable insights for GPs and LPs. Join us to explore the latest trends shaping the investment landscape.

For more information, please contact Charles Gould.

charles.g@pei.group | +44 (0)203 879 3893

Agenda

Responsible Investment Forum: Europe 2024 - Day One - Wednesday 20th

Registration & Networking Breakfast

Invitation only breakfast hosted by Key ESG: Supporting your portfolio on CSRD compliance

Many portfolio companies are facing a new ESG reporting challenge with the CSRD. These companies often lean on their investors for guidance and support. During this CSRD-focused breakfast session hosted by KEY ESG, you will learn about the different challenges arising from CSRD requirements and how they can be addressed to build repeatable, scalable and auditable reporting processes across your portfolio of investments

Facilitator: Heleen van Poecke, Co-founder and CEO, KEY ESG

Chairpersons opening remarks

Christopher Springham, Formerly VP – Communications and Sustainability, LM Wind Power GE Renewable Energy Business

Christopher Springham

Formerly VP - Communications and Sustainability, LM Wind Power GE Renewable Energy Business

Read bioKeynote Fireside Chat: the future of sustainability in private markets

Tom Reichert, Global CEO, ERM

In conversation

Kurt Björklund, Executive Chairman, Permira

Co-facilitators towards end of session

Allegra Day, ESG Director, Cinven

Euan Long, Climate Specialist, Permira

The continued evolution of the sustainability function within European private equity

- Comparing sustainability team designs: eg inhouse vs. external consultants

- Strategies for ESG leaders to effectively engage with portfolio companies, deal partners, and value creation teams

- To what extent are sustainability heads involved in due diligence processes and throughout the entire investment lifecycle?

- How is AI going to impact the role of sustainability heads? And how is it already being used?

- Balancing sustainability performance and value creation with increasing sustainability regulation

Moderator: Alan Kao, Principal and Global Director, ESG Services, Ramboll

Michael Marshall, Director of Investment Risk and Sustainable Ownership, Railpen

Daniel D’Ambrosio, Partner, Kirkland & Ellis

Denise Odaro, Head of ESG and Sustainability, PAI Partners

Phil Davis, Director of ESG, Helios

EDCI Annual Update: leveraging EDCI Insights for value creation

- Presenting the latest discoveries from the EDCI and a deep dive into the data

- Understanding how LPs utilise the data in practice: navigating uniform metric standards while prioritising materiality in benchmarking

- Insights into the correlation between sustainability efforts and financial performance in private markets

- Analysis of findings from the newly introduced net-zero metric and the path to decarbonization

- Assessing measurable outcomes within individual portfolio companies after three years of implementation: what progress have GPs observed?

Moderator: Greg Fischer, Partner & Director, BCG

Co-Facilitator: Ben Morley, Partner and Associate Director, BCG

Katharina Neureiter, Co-Head Global Sustainability, The Carlyle Group

Samantha Hill, Managing Director – Sustainable Investing, CPP Investments

Nicole Peerless, Head of Global Business Engagement, Pulsora

Chloe Sanders, Head of ESG, CVC Capital Partners

Coffee & networking

iCI initiative update: Advancing decarbonisation pathways at both fund and portfolio company levels

-

- To what extent are firms engaging with SBTI’s to validate decarbonisation strategies? Considering why some firms do not plan to set targets

- Practical steps for enhancing data collection, quality, and transparency in implementation efforts

- Exploring the complexities of scope 3 emissions and their status within private markets

- Case studies and guidance to drive emissions reduction through supplier engagement

Moderator: Marc Lino, Senior Partner, Global ESG Leader for Private Equity, Bain & Company

Mark Fischel, Head of Product, Novata

Serge Younes, Partner, Global Head of Sustainability, Investindustrial

Natasha Buckley, Principal, ESG, HarbourVest Partners

Sofia Bartholdy, Responsible Investment Integration Director, Church Commissioners for England

The integration of ESG into value creation plans

- Balancing the long-term positive impact from ESG initiatives when the benefits may be realised by subsequent owners

- Exploring avenues beyond mere energy conservation to identify tangible benefits derived from comprehensive ESG practices

- Moving beyond anecdotes: how do you demonstrate value & measure outcomes?

- Highlighting case studies where ESG implementation has increased exit valuations and overall returns

Moderator: Laurence Denvir, Director – Private Equity, WTW

Aditya Vikram, Head of Private Equity, UNPRI

Jennifer Flood, Sustainability, Head of North America, Investindustrial

Jennifer McCraight, Vice President, Permira

Zara de Belder, UK Service Line Lead, ESG Transactions & Sustainable Finance, Anthesis

Investor perspectives on the significance of sustainability on investment decisions

- To what extent is ESG impacting investment decisions?

- How are LPs integrating the EDCI within their wider data requests?

- LP views on the effectiveness of ESG strategies in driving long-term value and mitigating risks

- What are the new areas LPs are asking managers about?

Moderator: Jennifer Wilson, CEO & Founder, Re:Co

Karin Bouwmeester, ESG Lead Private Equity, PGGM Investments

Maaike van der Schoot, Head of Responsible Investment, AlpInvest Partners

Anna Grgic, ESG Integration Manager, AP6

Sabrina Sargent, Senior Director – Private Equity, PSP Investments

Lunch

Opening Remarks

Maarten Biermans, ESG & Investor Relations, Prow Capital

Portfolio company perspectives on sustainability and ESG performance improvement

- How are portfolio companies balancing the expectations of their PE sponsors with their other stakeholders?

- Investigating the collaborative strategies employed by portfolio companies in partnership with their investors.

- What are the key ESG focus areas to improve performance and create real business value?

Moderator: Alessandro Casoli, UK Principal, Holtara, powered by Apex Group

Oscar Sandell, Chief People &Sustainability Officer, Saferoad

Isabelle Demoment, CSR, Product Stewardship and Regulatory Director, Kersia

Angela Williams, Chief People Officer, Corsearch

How sustainability can be used to drive value creation within portfolio companies

- Implementing effective ESG integration across portfolios

- Evaluating ESG risks and opportunities: how is ESG influencing the investment thesis?

- To what extent can technology and data providers help portfolio companies with their value creation plans?

- Getting buy-in from all key stakeholders on the approach to ESG

Moderator: Manuela Fumarola, Director, EMEA Lead – ESG & Impact Value Creation, ERM

Viviana Occhionorelli, Head of ESG & Partner, Astorg

Elena Mariotti, Managing Director, Head of ESG Stewardship, Cerberus Capital Management

Holland Davis, Principal, HarbourVest Partners

Driving DE&I in portfolio companies as part of value creation

- What initiatives can help increase diverse representation at portfolio companies?

- Setting realistic targets for driving change on DE&I that fit withing growth expectations

- Working with management teams when your own house may not be in order

Moderator: Katie Hollis, Global Head of Credit, WTW Investments

Olga Wilheim, Impact & Client Relations Manager, GENUI

Nick Chee, Associate Director, ESG & Stewardship, AustralianSuper

Opening Remarks

Christopher Springham, Formerly VP – Communications and Sustainability, LM Wind Power

Christopher Springham

Formerly VP - Communications and Sustainability, LM Wind Power GE Renewable Energy Business

Read bioEvolution of the impact investing market: opportunities, trends and challenges

- As ‘impact hushing’ increases, is the impact label a good thing for fundraising at present?

- Is the pool of impact-orientated capital growing?

- Which themes and sectors within the impact market present the best return potential?

Moderator: Greg Fischer, Partner & Director, BCG

Julie Wallace, Head of Impact, LeapFrog Investments

Maarten Hage, Vice President (Climate), Helios Investment Partners

Edward Donkor, Partner Global Impact team, Apax

Dr. Borja Fernandez Tamayo, Vice President, Unigestion

Allocator insights on impact: guidance on what LPs should look for and how funds can make themselves investable

- Diligence strategies for LPs when assessing new investment opportunities

- What are the key factors for LPs when evaluating impact funds?

- How to assess emerging impact funds without track records

- Views on investing in pure impact funds vs. generalists with an impact strategy

Moderator: Toby Mitchenall, Senior Editor, ESG and Sustainability, New Private Markets, PEI

Sarah Miller, Senior Vice President – Manager Research, Redington

Anita Bhatia, Board Member, Joseph Rowntree Foundation

Stéphane Villemain, Vice President, Sustainability, CDPQ

Danyal Sattar OBE, CEO, Big Issue Invest

Impact measurement and management: Best practices in quantifying and reporting impact

- What are the principles and reporting norms that are emerging for impact funds?

- To what extent are funds differentiating between the different ‘shades’ of impact across their portfolio?

- Which impact methodologies and measurements are generalist funds picking up and using?

Moderator: Misa Andriamihaja, Founder, Green Ventures Capital

Nora Schulte, Chief Impact & Client Relations Officer, GENUI

Marc Williams, Principal, ESG and Impact, Blue Earth Capital

Abrielle Rosenthal, Managing Director and Chief Sustainability Officer, TowerBrook Capital Partners

Opening Remarks

Erika Blanckaert, Senior Public Affairs Manager – Head of Sustainability, Invest Europe

SFDR Update: how does the regulation work in practice?

- How to define ‘harm’ as it relates to the Principal Adverse Impact (PAI) indicators within your investment approach

- Examples of E or S characteristics pursued by Article 8 funds: Is there a market standard?

- Outlining some of the challenges with taxonomy reporting for LPs

- To what extent can tech be used to enhance SFDR compliance

Moderator: Marta Jankovic, Head of Sustainability, Stafford Capital Partners

Patricia Volhard, Partner, Debevoise& Plimpton

Laura Callaghan, Associate Director of ESG Services, Novata

Robert Sroka, Partner and Head of the Value Enhancement Team, Abris Capital Partners

How regulation can drive value creation: practical tips for ESG professionals

- Turning the CSRD and other reporting and disclosure requirements into an advantage

- Building a track record and credibility using data

- Engaging effectively with investors and portfolio companies

- Empowering your portfolio to report efficiently and focus on value creation

Moderator: Dr. Silva Deželan, Head of Impact & ESG, Forbion

Saleh ElHattab, CEO, Gravity

Sophia Walwyn-James, ESG & Sustainability Director, 3i Group

Michael Viehs, Managing Director, Global Head of Sustainable Investing, Partners Capital

Alison Prout, ESG Transformation Specialist, Agilitas Private Equity

Private Markets ESG Regulatory Landscape: A Global Update (Chatham House)

- How can global investors reduce the burden of regulations and frameworks that lack interoperability?

- Which regulations and frameworks naturally align with one another?

- Comparing regulations in the US & Asia to Europe

- Where next for the regulators?

Moderator: Rhys Davies, Partner – ESG & Impact, Kirkland & Ellis

Chris Shaw, Technical Director, ESG Advisory and Mandatory Reporting, Anthesis

Christina Bortz, Deputy General Counsel, ESG, TPG Angelo Gordon

Opening Remarks

Carmela Mondino Borromeo, Independent, ESG Specialist

Revolutionary approaches to Decarbonisation

- What does best practice look like when decarbonising a portfolio company?

- Addressing the financial shortfall in decarbonisation Initiatives

- An exploration of emerging and innovative investment strategies

Moderator: Deike Diers, Partner, Sustainability for Private Equity and Financial Investors, Bain & Company

Frederik Dagø, Decarbonization Director, FSN Capital

Elsa Palanza, Global Head of Sustainability and ESG, ICG

Mahesh Roy, Investor Strategies Programme Director, IIGCC

How to practically approach biodiversity as an investor

- Why aren’t LPs pushing harder on biodiversity?

- To what extent is biodiversity a potential distraction from decarbonisation?

- How to assess biodiversity risks and opportunities in the diligence process

Moderator: Charles Avery, Reporter, New Private Markets

Marie-Anne Vincent, Head of Finance, AXA Climate

Jovana Stopic, ESG Director, IK Partners

Peter Bachmann, Managing Director, Sustainable Infrastructure, Gresham House Mona Huys, Sustainable Investment Specialist, Mercer Alternatives

Sustainability and climate integration in private credit

- Can private credit ever do more than private equity, or must they always follow?

- How investors and managers have collaborated to enhance transparency in private credit

- What tools can private credit investors use to understand where their portfolio stands in terms of decarbonisation status and climate risk?

- What’s next?

Moderator: Rajen Gokani, Executive Director, Sustainability and Impact Investments Lead, GCM Grosvenor

Isabelle Mitchell, ESG Lead, Permira Credit

Vlad Mitroi, Head of ESG, Chenavari Investment Managers

Alicia Forry, Head of ESG, Alternative Investments, Direct Lending, Investec

Salma Moolji, European ESG Lead, Ares Management

Coffee & networking

Working Group Series A - Practical tips for using AI in day-to-day work

Practical tips for using AI in day-to-day work

Facilitator: Billy Cotter, Head of ESG, Dasseti

Working Group Series B - Building a coherent plan for biodiversity

Grant Rudgley, Technical Director, The Biodiversity Consultancy

Zoe Haseman, Infrastructure Head of Sustainability, EQT

Samantha Lacey, Strategic Director, Nature Finance, The Biodiversity Consultancy

Working Group Series C - ESG-linked debt: how to help portfolio companies access lower interest rates

Daan Schipper, Senior Director, Northern Europe, Holtara, powered by Apex Group

Alessandro Casoli, Head of Advisory UK & Deputy Head of Holtara UK, Holtara, powered by Apex Group

Caitlin Thompson-Geering, Director, Barings

Working Group D- Driving Portfolio-wide Decarbonization: Overcoming the Data Challenge and deploying the PMDR

Deike Diers, Partner, Sustainability for Private Equity and Financial Investors, Bain & Company

Mégane Mühlestein, Senior Manager, Sustainability for Private Equity and Financial Investors, Bain & Company

Thomas Carlier, Vice President, Sustainability, Investindustrial

Nathalie Medawar, Director, ESG, Astorg

Working Group E-Shifting engagement focus from regulation compliance to value-add opportunity

Building effective networks to help grow your business in private markets sustainably

Join this exclusive networking and learning session, where advisors will gain practical tips to enhance their success in working with private equity. Engage with industry peers to discuss what works—and what doesn’t—in this dynamic field. A must-attend session for all service providers at the event.

Facilitator: Christopher Springham, Formerly VP – Communications and Sustainability, LM Wind Power GE Renewable Energy Business

Christopher Springham

Formerly VP - Communications and Sustainability, LM Wind Power GE Renewable Energy Business

Read bioCocktail reception

Agenda

Responsible Investment Forum: Europe 2024 - Day Two - Thursday 21st

Registration & Networking Breakfast

GPs Breakfast Roundtable hosted by EY: Infusing ESG into operations and investing

To maximize financial returns, ESG must evolve into a fully integrated practice that permeates all operations from LP fundraising to exit planning.

Chase Jordan, Global Private Equity ESG Leader, EY

LP Breakfast Roundtable hosted by ILPA

Join your fellow Limited Partners for a networking breakfast and peer-to-peer conversation around the current challenges and opportunities LPs are facing pertaining to ESG and sustainability in 2024. Discussions will take place under Chatham House rules

Matt Schey, Managing Director, External Affairs & Sustainable Investing, ILPA

Opening Remarks

The big debate: balancing ambition and practicality when setting science-based targets

- Addressing concerns around the operational challenges of setting science-based targets

- Understanding the practical challenges around setting targets at a portfolio level

- Meeting LP and regulators expectations on targets and transition plans

- Case studies: successes and lessons learned

Moderator: Ellen McCormack, Head of Europe, Watershed

Lucy Ronan, Senior Sustainability Manager, Octopus Investments

Madeleine Evans, Director, Generation Investment Management

Eimear Palmer, Partner, Global Head of Sustainability, Pantheon Ventures

Grant Rudgley, Technical Director, The Biodiversity Consultancy

Sustainability during exits in a challenging environment

- To what extent are sustainability teams involved in exit preparation?

- How driving impact broadens the potential pool of buyers and can enhance valuations

- ESG considerations when exiting via IPO vs. a sale to another PE buyer

- Leveraging ESG to drive multiples at exit

Moderator: Jo Daley, Director, Head of Impact, Clearwater

Graeme Ardus, Head of ESG, Triton Partners

James Palman, Sustainable Investment Manager, Gresham House

Shami Nissan, Partner, Head of Sustainability, Actis

Tricia Winton, Partner and Global Head of ESG, Bain Capital

Navigating complex supply chains in private equity

- What questions are investors asking managers on supply chains?

- How is increased scrutiny impacting how managers approach this issue?

- Strategies for enhancing transparency and accountability across the supply chain

- The role of technology and data analytics in assessing and managing supply chain risks

Moderator: Eric Bloom, COO & Head of Client Solutions, Re:Co

Ana Alvarez Grullón, Managing Director – Head of ESG & Sustainability, Keensight Capital

Cornelia Gomez, Global Head of Sustainability, General Atlantic

Angela Wiebeck, Chief Sustainability Officer, Aquila Capital

Fabio Ranghino, Head of Sustainability & Strategy and Partner, Ambienta

Coffee & networking

Assessing AI’s impacts on sustainability and the sustainability role

- Examples of how AI is being used during ESG assessments during due diligence

- Leveraging AI across the whole investment cycle

- Considering some of the possible negative uses of AI for example how it could be used to help with greenwashing

- What are the most material impacts from AI on sustainability? What will generative AI help most with in future years?

Moderator: Chandini Jain, Founder & CEO, Auquan

Budha Bhattacharya, Head of Systematic Research, Lombard Odier Investment Managers

Simon Fahrenholz, Head of Sustainability, EY Germany

Hannah-Polly Williams, Director, Head of Sustainability, Europe, CD&R

ESG Controversies: A Comparative Study of Public vs Private Sectors

A unique presentation outlining the differences between public and private companies. Public companies, due to their significant market presence and mandatory financial disclosures, often face intense media scrutiny, amplifying any ESG controversies in public and online discussions. In contrast, private companies operate with greater discretion and less external pressure. This session will explore how these dynamics affect company operations, public perception, and management strategies.

Sylvain Forté, CEO & Co-founder, SESAMm

ESG Value Creation Excellence Stories

3 short presentations on how ESG initiatives or technologies can be used to drive returns within PE investments within different areas of sustainability. The audience will have the chance to quiz the presenters, and vote on the most impressive story. During the lunchbreak presenters will be available for further questions over informal roundtables.

Facilitator: Claudia Hobl, Partner & Associate Director, Climate & Sustainability, BCG

Angus MacDonald, Chief Hospitality Officer, Phoenix Capital Partners

Jill Brosig, Senior Managing Director, Chief Impact Officer, Harrison Street

James Magor, Director, Sustainability, Actis

Lunch

Regulatory workshop: sustainability regulation for private markets

Led by Travers Smith, their ESG & Impact experts will lead an interactive workshop where they will discuss the latest developments in regulation and practical approaches to them.

Simon Witney, Senior Consultant, Travers Smith

LP – GP collaboration workshop: raising the climate bar

The session will focus on LP-GP collaboration and engagement on climate change, highlighting key initiatives, expectations, and challenges, as well as need to drive value creation and real-world outcomes.

The session will be in the form of a dynamic debate among speakers on this critical topic, followed by an interactive discussion with the audience.

Aditya Vikram, Head of Private Equity, PRI

Sofia Bartholdy, Responsible Investment Integration Director, The Church Commissioners

Katsuki Tsuboi, Head of Sustainability, Dai-ichi

Judy Cotte, Head of ESG, Onex

Isoline Degert, ESG Director, InfraVia Capital Partners

Sofia Bartholdy

Responsible Investment Integration Director, Church Commissioners for England

Read bio

2024 Speakers

For information on speaking at the event, please contact Charles Gould.

charles.g@pei.group | +44 (0)203 879 3893

Marc Lino

Senior Partner, Global Sustainability Leader for Private Equity and Financial Investors, Bain & Company

Christopher Springham

Formerly VP - Communications and Sustainability, LM Wind Power GE Renewable Energy Business

Connect with global investors focused on the future of the market

Position your business with an authoritative content-led event portfolio focused on ESG and responsible investing. Be recognised as a go-to solution provider for senior private markets professionals and institutional investors.

Sponsorship gives you the opportunity to:

- Shake hands with 600+ prominent fund managers, global institutional investors, and highly recognised associations and expand your network of responsible investment professionals.

- Stand tall from your competitors by showcasing your company’s ESG and sustainability solutions and your industry expertise with thought leadership opportunities on the event program.

- Discover brand opportunities to position your services and solutions to a global ESG community.

For more information on available sponsorship opportunities please fill in the enquiry form. Contact Chris Wagland at chris.w@pei.group or call +44 (0) 0207 566 5475

2025 sponsors:

Network with the European responsible investment industry

In its 15th year, the forum is a firmly established event in the industry’s calendar.

Join 600+ attendees this November to connect with institutional investors, fund managers, specialist responsible investment and impact managers, and the wider ESG community for two days of learning and networking. This is a must-attend event for those with an interest in ESG in private markets.

Join focused discussions

Engage in discussions with investors and your peers on issues shaping the global investment landscape, by putting your questions to the expert speakers. Leave with insights relevant to your strategies.

Connect ahead of the event

Utilise the event networking app ahead of and during the event. View the attendee list in advance and book in meetings with investors and fund managers to ensure efficient networking at the event.

Relax and interact

Network during interactive workshops, drinks receptions, invite-only breakfasts, closed door working groups, and more. Build new relationships or re-connect with existing contacts to advance your fundraising.

Connect with responsible investment professionals

Testimonials from attendees

Alan Kao

Ramboll

Fantastic to see the progress on climate, diversity, human rights being made by so many investors!

Bill McGilivray

Ogier

The best conference I’ve attended in a very long time. Great content and speakers and very enthusiastic attendees make the 2 days well worthwhile.

Marina Johnson

Actis

Fantastic opportunity to meet with peers, to connect and challenge each other. Very well organised and run.

Pre-Event Resources

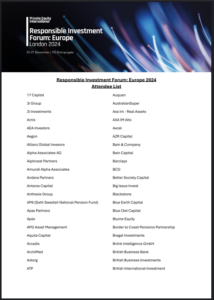

Institutional Investors at the Responsible Investment Forum: Europe 2024

The Responsible Investment Forum: Europe provides a leading platform for leading institutional investors and allocators investing in responsible investment in private equity to gather.

A limited number of complimentary passes are available for institutional investors to attend the event. Check out the benefits of joining the conference, who among your peers attends and find out how to apply for a complimentary pass for you or your team below.

What to expect at the forum?

Network with your peers

Enrich your network, build lasting relationships, and exchange valuable perspectives with your investor peers through investor-only breakfasts, networking breaks, lunches and much more.

Gain expert insights

Hear from our industry-leading speaker line-up, discover the latest trends and stay aligned with future innovations within ESG and responsible investment.

Explore opportunities

Discover remarkable investment opportunities in emerging sectors and discuss climate change within a portfolio, regulatory changes, the growth in impact and what it means for ESG, value creation and much more.

Meet with the best and brightest funds

Connect and arrange one-to-one meetings with the biggest fund managers and alternative asset professionals with an interest in ESG and responsible investment.

Apply for a complimentary institutional investor pass

A limited number of complimentary passes are available for allocators and institutional investors to join the event.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will follow up with you to secure your pass.