Masashi Kataoka

General Manager, Alternative Investment Department, The Dai-ichi Life Insurance Company

8 - 9 June 2022,

Shangri-La Tokyo

Join the PEI Responsible Investment Forum: Tokyo in-person on 8-9 June in Tokyo to dissect current allocation trends contributing to positive change.

Reconnect with Japanese investors, global fund managers, and strategic partners to map out responsible and impact investment frameworks for positive growth in 2022 and beyond.

Key conversations shaping the Forum include:

To help keep you and your peers safe, we have embraced some common principles to ensure the smooth running of the Responsible Investment Forum: Tokyo.

Join the region’s biggest investors on the ground, including year-on-year attendees GPIF, Japan Post Bank, Tokio Marine & Fire Insurance and many more.

Japanese investors will unveil their impact investment approaches and challenges. Understand what they are looking for in an investment partner and where they are allocating.

Organise your meetings in Tokyo by contacting investors two weeks before the in-person event and continue to explore new opportunities with access to the attendee directory for five months post-event.

Hear from Japan’s leading investor, Japan Post Bank shares their ESG approach to scale their portfolio returns.

By securing your place in the Responsible Investment Forum: Tokyo, you will also get access to the Impact Investment Forum on 9 June. Learn more about how you can maximise your time in Tokyo today.

This conference boldly showed where ESG and investing are heading.

PEI’s Responsible Investment Forum brought together an impressive collection of the world’s leading thinkers and practitioners on considering ESG factors in pri…

If you are serious about integrating ESG into your investment strategy, you should attend this conference.

The Responsible Investment Forum: Tokyo virtual experiencewill connect your business with influential Japanese LPs and the world’s leading institutional investors, fund and asset managers, advisers, and strategic partners to light a path for responsible investment in private equity.

Our immersive virtual platform allows you to connect with the opinion leaders shaping the future of Asian and global responsible investment from the comfort of your (home) office, allowing you to stay ahead during volatile times.

The virtual conference will give you greater access and interactivity than ever before, with increased visibility, extended face-to-face networking, premium content available and connectivity with fellow attendees until the end of 2020.

View our how-to video below to discover ways to maximize the value you can gain at the virtual experience.

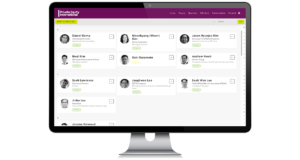

Enhanced search capabilities, including the ability to see the list of attendees to an agenda session and sophisticated filtering allow you to narrow down potential business partners by region, investment strategy and sector to ensure you don’t miss a single new opportunity.

Book unlimited 1-on-1 video meetings with Japanese LPs, speakers and global attendees in virtual meeting rooms. Just search for your desired attendees and invite them for a chat. Once you have set up your meeting you can invite other event attendees to join.

Through interactive roundtable sessions, you can knowledge-share with the global private equity community. Interactive roundtable is the virtual equivalent of a breakout or roundtable at a traditional conference, you will be face-to-face with like-minded peers to discuss the asset class’ latest trends and strategies.

Following panels during the conference week, speakers will be available for live Q&A to answer your questions. Discuss challenges and strategies with the panellists and your peers during and after the sessions.

The immersive virtual platform offers you limitless cross-border access to the global responsible investment community to discuss the challenges facing Asian markets and the allocation preferences of Japan’s leading LPs. Connect through unlimited virtual private meetings with the largest Japanese LPs and global GPs until the end of 2020.

Download the agenda to see the trends shaping Japanese investors’ allocation strategies and markets across the region. These topics will shape the discussions of the Responsible Investment Forum: Tokyo 2022.

Have a topic that you would like to discuss on the agenda? Contact Ms. Niann Lai today.

General Manager, Alternative Funds Investments Department, Sumitomo Mitsui Trust Bank

Read bio

General Manager and Head of Foreign Equity and Alternative Investment Department, Nissay Asset Management

Read bio

Director and General Manager, Fund Management Department, Osaka Shoko Shinkin Bank

Read bio

Chief Responsible Investment Officer, Sumitomo Mitsui DS Asset Management

Read bio

Senior Managing Director and Head of Private Equity Investment Department, Japan Post Bank

Read bioAgenda coming soon. Exact start time and end time are to be announced.

Representative Director and Chief Executive Officer, Social Investment Partners

Read bio

Senior Director, Private Sector Investment Finance Division1, Japan International Cooperation Agency (JICA)

Read bio

Executive Officer, General Manager, Sustainable Impact Development Division, Shinsei Bank

Read bio

Executive Officer, General Manager, ESG Strategy and Solutions Department, Sumitomo Mitsui Trust Bank

Read bio

General Manager, Responsible Investment Department, The Dai-ichi Life Insurance Company

Read bio

General Manager, Responsible Investment Office, Meiji Yasuda Life Insurance Company

Read bio

General Manager, ESG Investment Strategy Office, Finance and Investment Planning Department, Nippon Life

Read bio

View your event experience, attendee list and our speaking faculty.

We help brands to meet the right investors, close communication gaps, and maximise exposures among the influential responsible investment community. Attendees are exclusively decision-makers at the leading responsible/impact investors, fund and asset managers across the region and globe. Sponsorship gives you:

Contact Chris Wagland (chris.w@peimedia.com) to discuss your branding and thought-leadership options.

Download the agenda to see what crucial topics our industry-leading speakers will share.

Want to join our industry-leading speaking faculty? Contact our producer, Ms. Niann Lai today.

Shangri-La Hotel, Tokyo

Marunouchi Trust Tower Main

1-8-3 Marunouchi Chiyoda-ku, Tokyo

100-8283, Japan

To help keep you and your peers safe, we require you to follow the Covid principles below to ensure the smooth running of the Responsible Investment Forum: Tokyo 2022.

All attendees will be required to wear a filtering face piece mask without a ventilation valve.

Questions? Please contact asiaevents@peimedia.com.

The below information is as of 26 May 2022 and will be updated if health, safety and security guidelines change.

You need to be fully vaccinated against COVID-19 according to your national vaccine programme. Definition of fully vaccinated varies among cities, however, you will be required to take your 2nd dose at least 14 days before the event i.e. 25 May 2022.

PEI reserves the right to check the physical proof, photos of the vaccination record or digital proof via selected mobile apps.

If you had received your vaccination outside of Japan

PEI reserves the right to check the physical proof, photos of the vaccination record or digital proof via selected mobile apps.

You must measure your temperature at the entrance of the venue.

We will provide a partial credit to the next in-person Responsible Investment Forum event. Credits remain at the discretion of PEI Media.

Any questions regarding the event and vaccination requirements should be sent to asiaevents@peimedia.com.