Tom Connolly

Chief Investment Officer and Head of the Global Private Credit Group in Goldman Sachs’ Merchant Banking Division, Goldman Sachs Group

The inaugural PDI Tokyo Forum on 5 November 2019 will bring together more than 200 of Japan’s most active outbound investors and global GPs in the private credit space to analyse the latest trends in the market, discover new opportunities globally and build valuable connections for business growth.

Japan’s institutional investors are expanding their alternative investments to generate yield amid the low interest rate environment and, utilising Private Debt Investor’s position as the most trusted global debt-specialised publication, this Forum is your gateway to connect with Japan’s largest LPs and exchange insights with the most influential global GPs.

Key conversation topics at the conference:

As the ONLY conference specialised in private debt in Japan, the Forum is your gateway to meet with the most influential global GPs, exchange ideas on the latest market trends with peers and unlock the most sought-after investment opportunities in 2019 and beyond.

With a GP:LP raito of 2:3, the Forum is your perfect opportunity to connect with Japan’s behemoth institutional investors, learn about their fund manager selection methods, build connections and turbocharge your fundraising.

Demonstrate your skills and services packages to more than 200 senior private debt professionals globally and grow your business in the private credit and lending space. This is a conference you cannot afford to miss.

“Well thought through and relevant content. Provides good insight into how LPs think about this asset class.”

“Very well organized and structured. Great access to the assets’ leading players and insights.”

“PDI events bring private debt investment and structuring expertise together like no other conference I have attended.”

Following the news of Pension Fund Association for Local Government Officials’ (Chikyoren) debut in private corporate debt investment and its existing exposure to private lending, as well as GPIF’s recent $73.4 million commitment for direct co-investment along with IFC and Development Bank of Japan, Japan’s institutional investors are expanding their alternative investments to generate yield amid the low interest rate environment. There has never been a better time to connect with the Japanese investors and grow your business in 2019 and beyond.

Utilising Private Debt Investor’s position as the most prestigious publication specialised in private debt, the Forum will provide you the most exclusive analysis together with unrivalled insights from global senior private debt professionals.

Based on the latest PDI 50 research the private debt market is stable, with future funds targeting more region-specific opportunities.

200+

senior private debt professionals

80+

LPs

GP:LP ratio

Latest survey completed by Private Debt Investor research team shows that private debts LPs are looking to increase the number of GP relationships.

Join more than 200 Private debt senior decision-makers around the world at the PDI Tokyo Forum and seize the opportunity to share the future of the private debt while building invaluable connections with institutional investors and fund managers.

Join both the Tokyo and Seoul Forums in the same week to maximise your time in Asia

Invigorate your fundraising strategy by spending a week with Asia’s largest and most active outbound institutional investors in Japan and Korea by purchasing a single ticket. Connect with more than 200 Japanese and Korean LPs across two industry-leading events in Tokyo (5 November) and Seoul (7 November).

If you are fundraising in Asia, do not miss the chance to meet the regions’ largest LPs this November!

Key features of the Forums:

![]()

Supercharge your fundraising

Secure your next capital allocation by connecting with senior decision-makers from Japanese and Korean LPs.

![]()

Knowledge-sharing with opinion leaders

Strengthen your investment strategy by sharing ideas with the most influential debt investment community that gathers at all PDI global events.

![]()

Maximise your time and money

Take advantage of your time out of the office to gain the greatest business results possible by connecting with both of Asia’s major outbound LP communities in the space of one week.

Why are the 2019 Forums are a must-attend series? Find out the confirmed attendee list, speaker line-up and agenda highlights in the digital brochure.

Check out package options available and then secure your place today to maximise savings.

PDI Tokyo & Seoul Forums

full access

Boost your networking opportunities, and gain the best savings, by attending both the Seoul & Tokyo Forums on 5th and 7th November.

Includes:

PDI Tokyo Forum only

The inaugural Tokyo Forum on 5 November is a one-of-a-kind event in Japan focused on global private credit markets and outbound capital flows.

Includes:

PDI Seoul Forum only

The second annual PDI Seoul Forum on 7 November is Korea’s only conference exclusively focused on global debt strategies and fundraising opportunities.

Includes:

For any enquiries, please contact Niann Lai at niann.l@peimedia.com.

Governing Partner and Global Head of Direct Lending, HPS Investment Partners

Read bio

Senior Managing Director, Co-Head of Senior Lending, Churchill Asset Management

Read bio

Chief Investment Officer and Head of the Global Private Credit Group in Goldman Sachs’ Merchant Banking Division, Goldman Sachs Group

Read bio

Senior Investment Officer & Chief Operation Officer, AISIN Employees' Pension Fund

Read bio

Interested in speaking at the Forum? Please contact Ms Niann Lai at niann.l@peimedia.com.

See what’s new in 2020 edition, visit the PDI Tokyo Forum 2020 website now.

The PDI Tokyo Forum 2019 will offer a unique opportunity for organisations to raise their profile among 200+ senior private debt decision-makers across the world.

For exclusive sponsorship package for the PDI Tokyo Forum 2019, please contact sponsorship team at asiasponsorship@peimedia.com, call +852 2153 3846.

Private Debt Investor Conferences

asiaevents@peimedia.com

The $217bn public pension fund is adding private corporate debt to its portfolio as part of a five percent allocation to global alternatives.

By Adalla Kim | 20 July 2018

![]()

Japan’s Pension Fund Association for Local Government Officials, known locally as Chikyoren, has issued a Request for Proposals (RFP) as it searches for private debt, infrastructure, real estate, and private equity investment managers in Japan and overseas, according to its latest announcement. The RFP includes the first mandate dedicated to private debt investments.

Chikyoren is looking to invest in both domestic and offshore private debt via asset managers. Qualifying managers should have assets under management of over 100 billion yen ($885 million; €762 million) as of end-March, including the amount managed via trust accounts, the announcement states.

A senior investment officer overseeing the hiring process told PDI that Chikyoren is looking for private corporate debt opportunities both in the US and Europe.

Its prospective total commitment to alternatives will be made from one of two accounts being managed by the association. “The size of this capital pool accounts for five percent of our total assets under management,” the officer noted.

Its current exposure to alternatives stands at 0.4 percent, while the maximum allocation for alternatives is set at five percent of total assets – representing about 1.2 trillion yen ($10.7 billion; €9.1 billion) of its 23 trillion yen in total assets under management, as of end-March (the fiscal year 2017 ends on 27 March).

Further details regarding selection process and return expectations were not disclosed. There is no set deadline for submission of proposals nor a pre-determined commitment size for each mandate.

Chikyoren’s manager registration system operates on a rolling basis, similar to that of its larger peer, the Government Pension Investment Fund (GPIF) of Japan, which accepts proposals all year round and makes investment decisions accordingly.

It has gained exposure to illiquid credit via infrastructure debt and real estate debt investments.

Between June 2016 and March 2018, Chikyoren invested a total of 18.3 billion yen through four overseas infrastructure mandates, according to its latest annual report available only in Japanese.

These include a 3.4 billion yen commitment to Mitsubishi UFJ Trust Bank targeting European regulated assets, which delivered an annualised return of five percent in the fiscal year 2017.

A 3.5 billion yen mandate with JPMorgan Asset Management to invest in core infrastructure in OECD countries delivered an annualised return of 10.3 percent, while a 1.5 billion yen investment with Tokio Marine Asset Management targeting Australian assets, had generated a negative annualised return of 1.42 percent between July 2017 and March 2018.

The largest mandate of 9.9 billion yen landed with Mizuho Global Alternative Investments to invest in infrastructure debt globally. That had delivered a return of 0.77 percent during the last fiscal year.

The public pension has also awarded five real estate mandates for overseas and domestic investments and two domestic private equity mandates over the past two years.

Chikyoren manages the second largest pension pool in Japan after after the $1.4 trillion sized GPIF. Its assets come from pension reserves for members of local government organisations. It is the first among public pensions to issue an RFP for alternative investments in a bid to diversify its portfolio from a long-term investment perspective.

These institutions prefer floating rate-based loans to mitigate foreign currency hedging risks.

By Adalla Kim | 3 August 2018

More Japanese institutions are part of the alternative credit landscape this year.

Following Pension Fund Association for Local Government Officials’ announcement last month regarding its planned debut in private corporate debt investment, the world’s largest pension fund, Government Pension Investment Fund (GPIF), confirmed to PDI this week that it has existing exposure to alternative lending via a trust account.

GPIF’s commitment, sized at ¥8.2 billion ($73.4 million; €63.4 million), is for a direct co-investment along with International Finance Corporation and Development Bank of Japan, according to a spokesperson from the pension administrator.

It classifies this investment as an international equity allocation given its asset mix criteria as the commitment is held in a trust. A senior officer from IFC Asset Management Company declined to disclose details on investment targets and the name of the vehicle.

Regardless of which classification investors choose to record their investments, one notable theme seen among Japanese institutions that PDI spoke with is that they prefer lending against real asset collateral when making alternative credit investments.

“We are interested in real asset loans such as project-based debt financing,” said a senior offshore alternative investment officer from a Japanese institution who asked not to be named. He added that to achieve higher returns from private credit markets, his organization had chosen real estate debt and infra debt strategies.

Another example is Japan Post Bank, one of the two units of Japan Post Holdings, a holding company overseeing postal, banking, and insurance businesses. Its current alternative credit investment exposure includes mezzanine debt, distressed debt, infrastructure debt, and real estate debt fund commitments.

PDI understands that Japan Post Bank prefers non-recourse loans for real asset debt strategies as the bank seeks low correlation with systematic risk and underwriting based on the projected cash flow from specific transactions only.

Japan Post Bank also disclosed its existing exposure to senior secured direct lending funds, according to its latest mid-term management plan published on 15 May. It revealed to Private Equity International, a sister publication of Private Debt Investor, in March that it will focus on the US and European direct lending markets to seek a meaningful liquidity premium in exchange for the risk.

Although detailed figures were not disclosed, the bank plans to ramp up its alternative investments, targeting four percent of its total investment portfolio by end-March 2021.

Japan Post Bank’s alternative exposure is sized at 8.5 trillion yen ($76.1 billion; €65.5 billion) or one percent of its total portfolio assets as of end-March, according to the material.

INFRASTRUCTURE DEBT

Infrastructure debt is an asset class that has been attracting Japanese investors for the last five years.

Most recently, Dai-ichi Life Insurance Company, known as one of the most active Japanese institutions in alternative investments among its peer group, disclosed its anchor commitment of £70 million (¥10 billion; $92.4 million) to M&G Infrastructure Loan Fund.

The loan fund is a European infrastructure debt fund launched in March, targeting project finance loans and bonds for public-private partnerships (PPP) and infrastructure projects in Europe.

Jack Wang, a fund manager at Mizuho Global Alternative Investment, a Tokyo-based investment arm of Japan’s Mizuho Financial Group told PDI in April that it is possible for investment managers to mitigate cyclicality of the global credit market at a degree by investing in assets with long-term contracts with strong counter parties.

A deputy general manager in the offshore alternative investment team from a Japanese insurance firm told PDI that the insurer has committed to infrastructure debt, mezzanine debt, and direct lending strategies. He added that it has been expanding its investment in alternative investments to generate yield amid the low interest rate environment.

However, there are at least two aspects of infrastructure debt investment that investors should be especially careful about. “We should assess how vulnerable the project itself would be and what the structure of these projects is like in the initial stages,” Wang added.

According to a director of a Japanese institution who oversees offshore alternative investments, the biggest concern he has when looking at investment opportunities is the cost of hedging the Japanese yen against foreign currencies, adding that, whether or not general partners can provide a forex hedging solution is an important consideration.

Two industry practitioners told PDI that now, investors have to discount as much as 200 or 250 basis points on foreign currency exchange risk against the US dollar. “That is a significant effect on our investment returns,” one source added.

Given this, Japanese investors are watching out for US interest rate changes given that the foreign currency hedging cost results from a gap in the interest rates between the two countries. This has implications for the higher return expectations from overseas investment among Japanese institutions.

“Almost all Japanese investors have exposure [to these assets] in [Japanese] yen. They prefer a floating rate-based return structure as this feature can naturally hedge some of the costs borne by currency hedging,” Wang said.

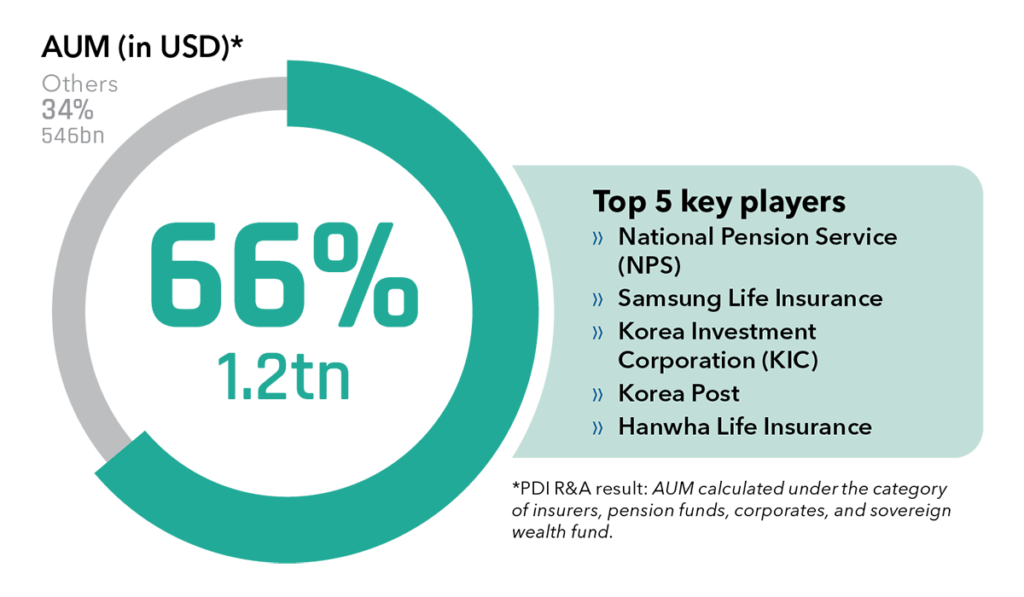

The second PDI Seoul Forum returns on 7 November 2019 with more than 100+ influential Korean outbound investors and fund managers in ONE room. If fundraising is your core business, do not miss the chance to meet both Japanese and Korean LPs in the same week.

KIC’s chief risk officer and executive vice-president, Seung Je Hong, told PDI: “I think the alternative investment industry is not standardised enough, and therefore it is perceived to be risky when making investment decisions by comparing return profiles with a GP’s peer group or their track records.”

Check out the key takeaways from Infrastructure Investor Seoul Summit and find out the current state of Korean investors