Richard Hulf brings a wealth of experience in investment and portfolio management, with significant expertise in the energy sector and capital projects. His extensive knowledge spans across listed and private companies, financial institutions, and various projects, giving him a well-rounded perspective as an investor, advisor, and practitioner.

Mr. Hulf’s career began at Rockwell International, where he established a new office in Kuwait following the Iraqi invasion, focusing on process control systems with the Kuwait Oil Company. He then transitioned to Enterprise Oil as a Petroleum Engineer before joining Exxon, where he managed several North Sea business units and later specialized in project economics.

His diverse experience includes roles as a sell-side analyst at Investec, an M&A advisor at Ernst & Young, and the establishment of an M&A practice in the UK centered on North Sea upstream oil and gas transactions at Simmons & Company. Building on this experience, Mr. Hulf founded Hulf Hamilton Ltd, an advisory firm specializing in energy company research and management consultancy. Under his leadership, the firm provided in-depth technical research and due diligence for oil companies, fund managers, and financial institutions involved in the upstream oil sector.

Mr. Hulf also served as a senior Fund Manager at Artemis Investment Management, where he co-managed the highly successful Artemis Global Energy Fund. This fund was a top performer in London, pioneering the ‘basin investing’ approach based on comprehensive analysis of global petroleum basins.

In addition to his professional accomplishments, Mr. Hulf serves as a Board Director for several companies, leveraging his extensive commercial and managerial expertise.

Mr Hulf holds a BEng (Honours) in Mechanical Engineering from Brunel University, London, a DSc and MSc in Petroleum Engineering from Imperial College, London, and is a Chartered Engineer (CEng).

Cordiant Capital

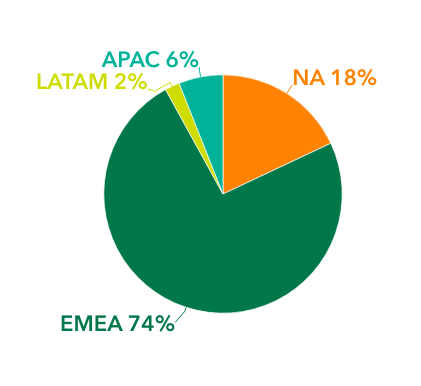

Cordiant is a specialist global infrastructure and real assets investment manager, with USD 4 billion in capital committed to Cordiant-managed funds across private equity and direct lending strategies.

Cordiant has a sector-led approach, focused on providing growth capital solutions to promising mid-sized companies in Europe, North America, and select Global markets.

Cordiant invests in the second generation of infrastructure and real assets (‘Infrastructure 2.0’), where (i)technology change, (ii) societal pressures, and (iii) strong secular trend-driven growth intersect. Our focus sectors, which embody these characteristics, are digital infrastructure, energy transition infrastructure and the agriculture value chain.

Cordiant priorities (i) sector knowledge and insight, (ii) a “Build and Grow” investment philosophy, and (iii) investing throughout the capital structure and jurisdictions, strongly believing these are the best ways to invest in infrastructure 2.0. In addition, Cordiant recognizes the need to effectively integrate responsible investment principles to better understand the challenges and identify the solutions that can foster the quality of our investments.

Partner-owned and partner-run since 2015, Cordiant has exceeded mandated investment targets for our clients on all funds since 2016.