Infrastructure

Investor

Network

America Forum

4 - 5 December 2024,

Convene 117 West 46th Street, New York

Fuelling growth: Transforming North America’s infrastructure landscape

The Infrastructure Investor America Forum hosted North America’s most influential investors, fund managers and policy makers for two days of unparalleled networking and content. Attendees re-connected with the community and debated trends shaping the North American infrastructure landscape.

100+

LPs

Pure play, infrastructure-focused LPs

.

80+ Speakers

Gain insights from industry leaders

.

.

270+ Industry leaders

Expand your network. Deepen relationships.

1:1

GP:LP

Unmatched

1:1 ratio

.

.

Key themes

The rise of infrastructure secondaries

.

.

US election– impact on the domestic infrastructure landscape

Creating value in uncertain times

.

.

Embracing artificial intelligence & technological innovation

Event highlights

Industry intelligence

Expert speakers and renowned keynotes discussed the current state of North American infrastructure, renewables, ESG, infrastructure debt and so much more.

Connect with senior industry professionals

Our event apps allow attendees to build their profile, view the comprehensive attendee list, send messages, connect and book meetings pre-event.

Exclusive sessions

Throughout the event, we hosted invite-only LP sessions, including an LP breakfast and a Women’s Circle for our female community.

Our speakers included:

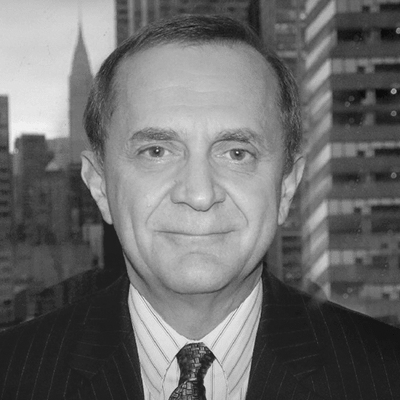

What attendees are saying about the forum

The PEI II team are constantly coming up with creative new ways to improve the learning, discussion, and networking experiences.

Steven C Rothberg

Mercator International LLC

Benefits of an Infrastructure Investor Network membership

Attendees of the Infrastructure Investor America Forum instantly become members of the Infrastructure Investor Network, a 12 month membership of global infrastructure leaders shaping the asset class.

Benefits include:

- Access to on-demand webinars, newsletters, surveys, slide decks and more, around issues impacting investment into infrastructure on an exclusive Network platform

- Connect better with investors and managers through the world’s largest Infrastructure Network Directory, use the advanced filtering system to find the right people for you

- Use the Network’s bespoke connection service by letting us who are you are looking to meet and why, and our Network team will make confidential introductions

- Join closed-door women and investor-only groups throughout the year in confidential, off-the-record sessions.

- The Network’s experienced team will be on hand to help you at Summits, Forums and beyond, guiding you to get the most out value from your membership

Pre-Event Resources

If you are interested in speaking at the America Forum, please contact Kitty Watson

Speakers include:

Valtin Gallani

Managing Director; Group Head of TMT and Digital Infrastructure Finance and Advisory, Societe Generale CIB

Carolyn Hansard

Managing Director, Portfolio Head Energy, Natural Resources and Infrastructure, Teacher Retirement System of Texas

Winston Ma

Executive Director of Global Public Investment Funds Forum and Adjunct Professor, NYU School of Law

For more information on speaking at the America Forum, please contact Kitty Watson

E: Kitty.w@pei.group

Agenda

Day 1 - Wednesday 4th

Registration & networking breakfast

Welcome from Infrastructure Investor

Chair’s welcome

Ashli Aslin, Senior Analyst Real Assets and Infrastructure, Albourne Partners

US Infrastructure investment: Strategies, advancements, and the journey towards growth

- A deep dive into the US’ continuous journey towards growth in infrastructure investment

- How technological advancements such as AI have enhanced the efficiency and sustainability

of infrastructure projects - Asset management M&A in infrastructure; trends and developments

- Predictions for the US infrastructure investment landscape for 2025

Moderator:

Jonathan Melmed, Partner, King & Spalding

Speakers:

Hamza Fassi-Fehri, Partner, Antin Infrastructure Partners

Josh Oboler, Investment Partner, Palistar Capital

Michael Ryder, Co-Head and Partner, Igneo

Leonie Maruani, Senior Director, Vauban Infrastructure Partners Americas

The energy transition: an opportunity for a North American infrastructure investor?

- Navigating the macro environment and its impact on the energy transition agenda

- Methods to successfully and effectively finance the energy transition

- The role technology has to play in the transition

Moderator: Justin McGown, Americas Reporter, Infrastructure Investor

Speakers:

Maria Zaheer, Managing Director, Head of North America, Alexa Capital

Vidyu Kishor, Investments Director, Osaka Gas USA

Sean Toland, Associate Partner, Flagship Investment Team, Copenhagen Infrastructure Partners

Creating value in an uncertain investment landscape

- Analysing value creation methods and practices carried out in the market across different

assets - Leveraging technology to enhance value creation in infrastructure investment

- LP views on the effectiveness of infrastructure investment in driving long-term value and

mitigating risks

Moderator: Taylor Hart, Partner, Ropes & Gray LLP

Speakers:

Ashli Aslin, Senior Analyst Real Assets and Infrastructure, Albourne Partners

Nicholas Hertlein, Managing Director, Stonepeak

Teresa Mattamouros, Managing Director, Goldman Sachs Alternatives

Don Dimitrievich, Portfolio Manager, Senior Managing Director, Energy Infrastructure Credit, Nuveen

Don Dimitrievich

Portfolio Manager, Senior Managing Director, Energy Infrastructure Credit, Nuveen

Read bioKeynote Fireside Chat: Investing in America’s Infrastructure

Sadek Wahba talks about his new book and his vision for how to build America’s infrastructure to secure the economic growth, productivity improvements and social benefits that a good infrastructure network can offer.

Speakers:

Sadek Wahba, Chairman & Managing Partner, ISquared Capital

Zak Bentley, Americas Editor, Infrastructure Investor

Coffee break

The influence of the US election on the domestic infrastructure landscape

- A deep dive into what’s next for American infrastructure sub sectors

- What the election means for the IRA

- Investor projections for infrastructure under the new administration

Moderator: Raya Treiser, Partner, Kirkland & Ellis

Speakers:

David Quam, US Advisor, GIIA

Jeremy Ebie, Co-founder and Managing Partner, Phoenix Infrastructure Group

Daniel Silverberg, Managing Director, Capstone

Exploring the benefits of alternative innovative investment frameworks

- How co-investments act as J curve mitigation strategies

- What drives investors to opt for infrastructure secondaries amidst tough market conditions?

- What is needed from an investor perspective for the infrastructure secondaries market to grow and mature?

Moderator: Eugene Zhuchenko, Managing Director, ETORE Advisory

Speakers:

Ying Lin, Vice President, StepStone Group

Paul Barr, Partner, Pantheon

Kevin Chang, Managing Director, Ares Management

Networking lunch

LP Lunch (invite-only)

Navigating elevated interest rates across infrastructure investment

- The impact of interest rates and inflation on the infrastructure

subsectors - How infrastructure investors plan to tackle the tailwinds from the increase in interest rates

- Comparing core infrastructure to value add/optimistic strategies amid the increase of interest

rates

Moderator:

Guy Hopgood, Director, bfinance

Speakers:

Grant Hodgkins, Director, BCI

Surinder Toor, Managing Partner, Arjun Infrastructure Partners

Recep Kendircioglu, Global Head of Infrastructure Equity, Manulife Investment Management

The growth of emerging managers and mid-market infrastructure players

- Establishing a clear differentiation between emerging and mid-market managers

- How do emerging managers prove themselves to LPs without a proven track record

- Strategies for new managers to establish themselves in the marketplace

Moderator: Daniela Arreaza, Investment Banking Associate, DC Advisory

Speakers:

Dr. Barbara Weber, Founder, B Capital Partners

Donnett Campbell, Managing Director, SS&C Technologies, Inc

Peter Larsen, Managing Director, Hamilton Lane

Vicente Vento, CEO, DTCP

Where is the value in ESG?

- How ESG data can help demonstrate performance to help make meaningful change

- How ESG can increase profitability and investment

- Why is ESG reporting important?

Moderator: Susan McGeachie, Founding Partner and CEO, Global Climate Finance Accelerator

Speakers:

Jennifer Essigs, Head of Sustainability, AE Industrial Partners

Bill Green, Managing Partner, Climate Adaptive Infrastructure

Charles Buck, President and CEO, United Church Funds

Navigating the consequences of fibre to the home overbuild

- Exploring strategies for sustainable growth and how to mitigate the negative impacts of fibre overbuild

- Investigating methods to adapt to changing market conditions and the slow-down in dedicated digital allocations

- Comparing strategies to avoid further overbuild

Moderator: David Strauss, Principal, Broadband Success Partners

Speakers:

Valtin Gallani, Managing Director; Group Head of TMT and Digital Infrastructure Finance and Advisory, Societe Generale CIB

Goncalo Bernardo, Investment Partner, Palistar Capital

Kevin Genieser, Managing Partner, Antin Infrastructure Partners

Valtin Gallani

Managing Director; Group Head of TMT and Digital Infrastructure Finance and Advisory, Societe Generale CIB

Read bio

Traditional energy “having it’s moment again” – what this means for moving towards net zero

- How do we standardize a strategy to meet net zero?

- How do we use the same terminology?

- Predictions for the renewable and energy transition market over the coming years

Moderator: Andrea Logan, Director, FirstPoint Equity

Speakers:

Anthony Liparidis, Director of Real Assets, Bessemer Trust

Michael Felman, Owner, MSF Capital Advisors

Michele Armanini, Managing Director – Investments, Infracapital

Michael Sheehan, Chief Operating Officer, Dimension Energy

Investing in America’s transport infrastructure

- What the federal government incentives look like under the new administration to support infrastructure investment

- Strategies to enhance the sustainability of transport infrastructure and how to finance them

- Investor perspectives on the transportation sub sector

Moderator:

Catarina Moura, Senior Reporter, Infrastructure Investor Deals

Speakers:

Duane Callender, Acting Executive Director, Build America Bureau

Jay Gillespie, Director of Alternative Finance, Georgia Department of Transportation

Rich Juliano, General Counsel, American Road & Transportation Builders Association

Joe Seliga, Partner, Mayer Brown LLP

Coffee break

North American LP investing strategies under the microscope

- Infrastructure vs other alternative asset classes. How is infrastructure faring?

- Will thematic investments continue to dominate investing opportunities?

- Investor perspectives on the rise of alternative investment strategies

Moderator: Mark Weisdorf, Chair of the Investment Committee, IST3 Infrastruktur Global

Speakers:

Monica Huffer, Portfolio Manager, Private Markets, Texas Municipal Retirement System

John Tsui, Managing Principal, Peninsula House

John Anderson, Global Head, Corporate Finance & Infrastructure, Manulife

Carolyn Hansard, Managing Director, Portfolio Head Energy, Natural Resources and Infrastructure, Teacher Retirement System of Texas

Carolyn Hansard

Managing Director, Portfolio Head Energy, Natural Resources and Infrastructure, Teacher Retirement System of Texas

Read bioChair’s closing remarks

Ashli Aslin, Senior Analyst Real Assets and Infrastructure, Albourne Partners

Cocktail reception

Agenda

Day 2 - Thursday 5th

Registration & breakfast

Chair’s welcome back

Ashli Aslin, Senior Analyst Real Assets and Infrastructure, Albourne Partners

Keynote Fireside Chat: Infrastructure Investing in the AI Era – sovereign investors’ perspective

Infrastructure has been an important asset class for the SWF and pension fund community. Now the traditional infrastructure sectors are under challenges, whereas digital infrastructure projects like cloud computing and data centers are on the rise. This fireside chat will cover the rising power of sovereign investors, long term capital for global digital infrastructure needs, and how new concepts like “sovereign cloud” and “sovereign AI” will complicate the global data infrastructure.

Speakers:

Catarina Moura, Senior Reporter, Infrastructure Investor Deals

Winston Ma, Executive Director of Global Public Investment Funds Forum and Adjunct Professor, Former MD of China Investment Corporation, NYU School of Law

The role of the energy transition on data centers and managing the increasing demand for AI

- Comparing existing strategies across the US to manage the power demand effectively and sustainably

- Exploring the growth in low-emitting data center providers in the US

- How companies are increasingly turning to off-the-grid experiments amid rising frustrations and navigating the associated regulatory and land acquisition challenges

Moderator: Canan Anli, Senior Advisor, GIRA Strategic Finance

Speakers:

Matthew Mendes, Managing Director, Head of Infrastructure, IMCO

Avantika Saisekar, Managing Director, Wafra

Quynh Tran, Deputy Head, Structured Finance, Americas, Sumitomo Mitsui Banking Corporation

Brice Soucy, Senior Director, Argo Infrastructure Partners

Timothy Dobney, Investment Director, Infrastructure, IFM Investors

Coffee break

Fireside chat with an Infrastructure Investor: What can superannuation bring to the US infrastructure market?

Debate: Conventional vs renewable energy sources

Moderator:

Ashli Aslin, Senior Analyst Real Assets and Infrastructure, Albourne Partners

Speakers:

Thierry Vandal, President, Axium Infrastructure (Renewable energy sources)

Michael Felman, Owner, MSF Capital Advisors (Conventional energy sources)

Networking lunch

Women in Infrastructure lunch (invite-only)

How to navigate the current fundraising environment

- Does infrastructure still offer the same beacon of hope for investors in turbulent times?

- How to navigate the unprecedented need for new infrastructure in a period of record-high government deficits and supply-demand imbalance

- What’s next for infrastructure fundraising as investors abandon the “wait and see” approach of 2023?

Moderator: Eugene Zhuchenko, Managing Director, ETORE Advisory

Speakers:

Anna Dayn, Managing Partner, New End

Phil Eichhorn, Director of Investments, Versus Capital Advisors

The contribution of infrastructure debt in delivering secure, long-term returns

- The role infrastructure debt plays in acting as a hedge against inflation

- Exploring the most popular strategies across the debt space

- What’s next for infrastructure debt investors

Moderator: Guy Hopgood, Director, bfinance

Speakers:

Luke Fernandes, Head of Infrastructure Finance, Swiss Re

Nirav Dangarwala, Portfolio Manager, Resolution Life

David Rosenblum, Fund Partner, I Squared

Rudi Stuetzle, Executive Director, Infrastructure Debt Americas, MEAG New York Corporation

Infrastructure Investor: Emerging Managers Investment Committee Case Study

Two hand-picked emerging fund managers will present an investment case study in this exclusive,

data-driven and interactive format. Hosted by an experts, you’ll have the chance to ask questions,

share your thoughts in our very own investment committee.

Speaker:

Izzet Bensusan, CEO, Captona

Li Xu, Managing Partner, LXI Capital

Market update from Infrastructure Investor

Bill O’Conor, Managing Director, Americas, PEI Group

Chair's closing remarks

Thank you to our 2024 sponsors:

Better connections with the Infrastructure Investor Network

Accelerate your fundraising

Find investors who match your investment strategies and set up meetings ahead of the event on our membership platform.

Expand your investor network

Showcase your profile ahead of the event and use our membership team to connect with the right decision makers.

Better connections

Access unique, critical insight exclusive to members throughout the year along with preferential rates to attend any event within the Infrastructure Investor portfolio.

Secure your next investor

America Forum attendees get more

Purchase 12-month Infrastructure Investor Network membership to attend the America Forum, and enjoy exclusive access to:

- Our network directory of 3,200+ leading investors and fund managers for you to connect with

- Invite-only peer groups, monthly webinars and knowledge hubs for deeper insights

- and so much more…

Institutional and private LPs at the America Forum

The Infrastructure Investor America Forum will be a pivotal event for LPs to connect with peers and managers to navigate the ever-changing infrastructure landscape.

Complimentary LP passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply for a pass and a member of our team will be in touch to confirm your eligibility.

Last year's attendees include

Key themes include:

What to expect at the Forum

Network with your peers

Enrich your network, build lasting relationships, and exchange valuable perspectives with your investor peers through investor-only breakfasts, networking breaks, lunches and much more.

Gain expert insights

Hear from our industry-leading speaker line-up, discover the latest trends and stay aligned with future innovations in the market.

Explore opportunities

Discover remarkable investment opportunities in sectors including emerging markets, energy transition, infrastructure debt and more.

Meet with the best and brightest funds

Connect and arrange one-to-one meetings with infrastructure’s biggest fund and asset managers in the market.

Apply for your complimentary pass

A limited number of complimentary passes are available for eligible allocators and institutional investors to join the event.

Complimentary investor passes are limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds who are actively making fund commitments and do not engage in third-party fundraising activities or collect fees for advisory/consulting services.

Apply today and a member of our team will follow up to secure your pass.

Gallery

Connect with and benchmark against your investor peers. Take part in roundtable discussions, think-tanks and investor-focussed sessions to explore opportunities within the asset class so you can leave with strategies to generate the highest returns.

Ross Alexander

Senior Portfolio Manager, Infrastructure/Real Assets, Alaska Permanent Fund Corporation

Laurie Mahon

Former Vice-Chair, US Investment Banking, Global Investment Banking, CIBC Capital Markets

Matthew Mendes

Managing Director, Head of Infrastructure, Investment Management Corporation of Ontario (IMCO)

Enhance your brand at the Infrastructure Investor America Forum 2024

Experience unparalleled opportunities at Infrastructure Investor America Forum 2024. Connect with senior decision-makers and leading infrastructure professionals, engage in enriching discussions, and drive lead generation. Join us to expand your network, establish thought leadership, and foster strategic partnerships.

The 2-day event offers a comprehensive view of the infrastructure landscape and will tackle challenges such as the impact of the US election on the domestic infrastructure landscape, how to create value in uncertain times, and embracing artificial intelligence and technological innovation. Showcase your solutions to empower them in overcoming these hurdles.

270+

Infrastructure professionals

100+

LPs

80+

Speakers

2

Days

Why sponsor the event?

Connect with senior investment professionals

Our engaged attendees – senior decision-makers – come from a diverse range of institutions, such as public and private pension funds, insurers, family offices, fund managers, investment consultants, fund of funds, law firms, banks, placement agents and more.

Boost brand visibility

Engage in exceptional networking with potential clients. Enhance your brand’s digital visibility and during live sessions. Utilise the Infrastructure Investor event app to facilitate seamless networking and collaboration opportunities.

Engage in insightful discussions

Sponsors can demonstrate their expertise and thought leadership on critical industry topics through speaking engagements and targeted content.

Maximize your ROI

Our sponsorship packages deliver exceptional value for your investment, offering a variety of benefits tailored to meet your specific needs and objectives.

Last year's investors include:

Unrivalled networking experience

The Forum offers unparalleled opportunities to network with infrastructure’s most influential leaders in New York. Our networking offering is the ideal setting to build strong relationships with LPs and secure commitments.

Day 1 drinks reception

- Exclusive sponsorship of our Private Drinks Reception

- Including canapes, sparkling wine, beer and soft drinks

- Branded at Official Drinks Reception Sponsor Level across brochure, signage and marketing collateral

Women’s lunch

- Opportunity to host a panel of senior women from within the industry for an interactive discussion around DE&I, recruitment, inclusion within businesses

- This session will be off the record and allow for a private lunch space to cultivate and grow your current network

- Branding as our Women’s Circle sponsor across brochure, signage, marketing collateral

Private meeting room

Private meeting room, set up in a board room style for

6-8 people for the duration of the conference.

Networking lounge

Branded lounge seating area for 4 people.

Barista sponsorship

- Exclusive sponsorship of our branded Barista Station providing coffee in branded and sustainable cups

- Branded as our Barista Sponsor across brochure,

signage and marketing collateral

Lanyard sponsorship

- Exclusive sponsorship of our lanyards for all conference attendees

- Branded as our Lanyard Sponsor across brochure, signage and marketing collateral

Expand your network. Deepen relationships. Secure capital.

Join us in December

Access to the America Forum

Purchase your Infrastructure Investor Network membership today to attend the forum.

If you are purchasing more than 3 tickets, please contact Anna Dorokhin

.

Investor pass

A limited number of complimentary passes are available for eligible allocators and institutional and private investors.

Limited to foundations, endowments, trusts, insurance companies, single family offices, sovereign wealth funds and pension funds.

Exclusive networking functions taking place at the event

Onsite networking

Investor Council Lunch

December 4

The LPs in attendance joined us for an exclusive LP lunch to gain peer-to-peer insights, build their networks and re-connect with existing connections.

Official Drinks Reception

December 4

To conclude the first day of the conference, we hosted a drinks reception with complimentary canapes and beverages for attendees to continue to network with their peers and reflect upon the day’s sessions.

Women’s Circle Lunch

Women’s Circle Lunch

December 5

We welcomed a panel of women leading North America’s infrastructure industry who shared their career journeys and discussed how their firms retain and promote women and D&I opportunities in infrastructure.